Tracing Papers Market: Global Industry Analysis and Forecast (2024-2030)

Tracing Papers Market size was valued at USD 450 Mn. in 2023 and the Tracing Papers revenue is expected to grow at a CAGR of 2.8% from 2024 to 2030, reaching nearly USD 545.96 Mn. by 2030.

Format : PDF | Report ID : SMR_2132

Tracing Papers Market Overview:

The tracing paper market remains resilient despite challenges posed by digital advancements and economic fluctuations. Widely used across art, architecture, and craft industries, tracing paper serves diverse needs from sketching and drafting to crafting and educational applications. Despite the prevalence of faster design tools such as CAD software and digital drafting alternatives, traditional designers may still find tracing paper appealing because of its tactile qualities and simplicity.

Sustainable practices and materials are focused on by manufacturers in order to mitigate profitability because of market carriage of raw material prices. Customer satisfaction and competitive advantage are guaranteed thanks to products highly tailored for each sector for instance architects prefer transparency while artists desire smooth surfaces. Despite this, possible market growth may be slowed by global economic uncertainties and supply chain disruptions. The trajectory of the tracing paper market as a whole is one of development driven by adaptability and innovation for consumer needs and changing industry frameworks.

To get more Insights: Request Free Sample Report

Tracing Papers Market Dynamics:

Tracing Paper Sustains High Demand Across Art, Architecture, and Craft Industries Despite Digital Advances

There are many different uses for tracing paper across art, architecture, and design industries which keeps the demand high. Sketch artists use tracing paper in order to transcribe permanent ideas from one paper to another then architects and engineers making sure they have exact drafts that are not too confusing also depend on opaque characteristics when they are making up blueprints. Crafters also like it because they can use it in many different projects such as scrapbooking and making greeting cards.

Established brands maintain dominance over distribution channels thanks to many retails shops all over which include those available online, these are purposed for single clients or the buyers who would want to acquire them in large quantities because of high number they require for example schools. Addressing increasing concern for sustainability, innovation in the market is oriented towards using eco-friendly materials that are long lasting but still of acceptable transparency levels. Traditional drawing practices still prefer tracing paper over digital alternatives and CAD software because of its touch feel and simplicity.

Tracing Paper Market Faces Competition from Digital Alternatives Amidst Economic and Environmental Challenges

Despite Having demand in various industries, the tracing paper market is faced with many challenges. One major challenge that it faces is rigid competition from digital alternatives and CAD software. These alternatives provide faster drafting solutions that are more flexible than those of the physical materials-based method. This shift poses a threat to traditional uses of tracing paper in architectural and engineering sectors. Manufacturing companies also face price volatility and reduced profitability arising from changes in the costs of raw materials. Innovation with regard to sustainable methods and supplies is one of the strategies being undertaken by the sector to overcome such problems.

While the art, architecture and craft sectors are characterized by different preferences and specific needs among their consumers thus needing products and distribution that address them specifically, the technological challenge remains to be how much of a product’s environmental friendliness can be compromised without sacrificing on its durability. Ultimately, there may be a slowdown in market growth prospects because of the impact of supply chain disruptions and global economic uncertainties on output and timeframes for distributing goods.

Tracing Papers Market Segment Analysis

By Type, the tracing paper market has numerous categories which have been created to meet the needs of different consumers and uses. For artists and designers, they prefer thin lightweight sheets that are easy to handle during sketching and tracing of complex patterns. These papers are preferred because they are clear and have smooth surfaces that allow one to draw more accurately. Medium weight tracing papers are preferred for architectural and engineering purposes since they have enough opacity to overlay blueprints and technical drawings and yet they are not fragile with constant usage.

For crafting and do-it-yourself projects, heavyweight tracing papers are used as they have sturdy surfaces which can stand up to multiple art techniques including embossing as well as mixed media applications. Art, design, crafting and educational fields all have varying tracing paper types that cater for certain needs so that using them meets particular transparency, heaviness and durability needs identified by its users. This strategy aids manufacturers and suppliers distribute their goods to varied market segments more effectively, so their products are used widely and they are happy, hence enhancing overall market penetration as well as consumer satisfaction.

Tracing Papers Market Competitive Landscape:

- In July 2022, Domtar Corporation announced the restarting of its paper machine at Ashdown, Arkansas, to cater to the growing demand. This is expected to help the company to expand its production Application.

- In April 2021, Pixelle Specialty Solutions announced the acquisition of two specialty paper businesses. The company acquired Rollsource from Veritiv Corporation and the security papers & carbonless rolls business from Appvion Operations Inc. This is expected to help the company to strengthen its product portfolio.

Tracing Papers Market Scope:

|

Tracing Papers Market |

|

|

Market Size in 2023 |

USD 450 Mn. |

|

Market Size in 2030 |

USD 545.96 Mn. |

|

CAGR (2024-2030) |

2.8 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Type Cellulose Fiber Tracing Paper Cotton Fiber Tracing Paper |

|

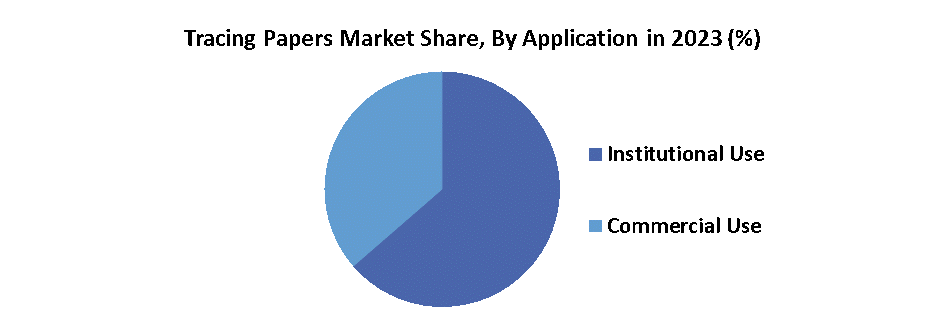

By Application Institutional Use Commercial Use |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Tracing Papers Market Key Players:

- Nippon Paper Industries Co., Ltd.

- Groupe Hamelin

- Mitsubishi Group

- Hyderabad Reprographics Pvt. Ltd.

- Asian Reprographics Private Limited

- ArjoWiggins Chartham

- Zhejiang Wuxing Paper

- Koehler Paper Group

- Asia Pulp & Paper Ltd

- Pixelle Specialty Solutions

- Oji Papéis Especiais LTDA

- Papeles y Conversiones de México

- Reflex GmbH & Co. KG

- Nekoosa Coated Products LLC

- Thermal Solutions International Inc

- Jiangxi Five Star Paper Co. Ltd

- Peters Papers

- Qingdao Focus Paper Co. Ltd

- Mitsubishi HiTec Paper Europe GmbH

- FILA-ARCHES sas

Frequently Asked Questions

Tracing Paper Market Faces Competition from Digital Alternatives Amidst Economic and Environmental Challenges are the challenge in the Tracing Papers Market.

The Market size was valued at USD 450 Million in 2023 and the total Market revenue is expected to grow at a CAGR of 2.8 % from 2024 to 2030, reaching nearly USD 545.96 Million.

The segments covered in the market report are by Type and By Application.

1. Tracing Papers Market: Research Methodology

2. Tracing Papers Market: Executive Summary

3. Tracing Papers Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Tracing Papers Market Import Export Landscape

5.1. Import Trends

5.2. Export Trends

5.3. Regulatory Compliance

5.4. Major Export Destinations

5.5. Import-Export Disparities

6. Tracing Papers Market: Dynamics

6.1. Market Trends by Region

6.1.1. North America

6.1.2. Europe

6.1.3. Asia Pacific

6.1.4. Middle East and Africa

6.1.5. South America

6.2. Market Drivers by Region

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East and Africa

6.2.5. South America

6.3. Market Restraints

6.4. Market Opportunities

6.5. Market Challenges

6.6. PORTER’s Five Forces Analysis

6.7. PESTLE Analysis

6.8. Strategies for New Entrants to Penetrate the Market

6.9. Regulatory Landscape by Region

6.9.1. North America

6.9.2. Europe

6.9.3. Asia Pacific

6.9.4. Middle East and Africa

6.9.5. South America

7. Tracing Papers Market Size and Forecast by Segments (by Value Units)

7.1. Tracing Papers Market Size and Forecast, by Type (2023-2030)

7.1.1. Cellulose Fiber Tracing Paper

7.1.2. Cotton Fiber Tracing Paper

7.2. Tracing Papers Market Size and Forecast, by Application (2023-2030)

7.2.1. Institutional Use

7.2.2. Commercial Use

7.3. Tracing Papers Market Size and Forecast, by Region (2023-2030)

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Middle East and Africa

7.3.5. South America

8. North America Tracing Papers Market Size and Forecast (by Value Units)

8.1. North America Tracing Papers Market Size and Forecast, by Type (2023-2030)

8.1.1. Cellulose Fiber Tracing Paper

8.1.2. Cotton Fiber Tracing Paper

8.2. Tracing Papers Market Size and Forecast, by Application (2023-2030)

8.2.1. Institutional Use

8.2.2. Commercial Use

8.3. North America Tracing Papers Market Size and Forecast, by Country (2023-2030)

8.3.1. United States

8.3.2. Canada

8.3.3. Mexico

9. Europe Tracing Papers Market Size and Forecast (by Value Units)

9.1. Europe Tracing Papers Market Size and Forecast, by Type (2023-2030)

9.1.1. Cellulose Fiber Tracing Paper

9.1.2. Cotton Fiber Tracing Paper

9.2. Tracing Papers Market Size and Forecast, by Application (2023-2030)

9.2.1. Institutional Use

9.2.2. Commercial Use

9.3. Europe Tracing Papers Market Size and Forecast, by Country (2023-2030)

9.3.1. UK

9.3.2. France

9.3.3. Germany

9.3.4. Italy

9.3.5. Spain

9.3.6. Sweden

9.3.7. Russia

9.3.8. Rest of Europe

10. Asia Pacific Tracing Papers Market Size and Forecast (by Value Units)

10.1. Asia Pacific Tracing Papers Market Size and Forecast, by Type (2023-2030)

10.1.1. Cellulose Fiber Tracing Paper

10.1.2. Cotton Fiber Tracing Paper

10.2. Tracing Papers Market Size and Forecast, by Application (2023-2030)

10.2.1. Institutional Use

10.2.2. Commercial Use

10.3. Asia Pacific Air Traffic Control (ATC) Communications Market Size and Forecast, by Country (2023-2030)

10.3.1. China

10.3.2. S Korea

10.3.3. Japan

10.3.4. India

10.3.5. Australia

10.3.6. Indonesia

10.3.7. Malaysia

10.3.8. Vietnam

10.3.9. Taiwan

10.3.10. Bangladesh

10.3.11. Pakistan

10.3.12. Rest of Asia Pacific

11. Middle East and Africa Tracing Papers Market Size and Forecast (by Value Units)

11.1. Middle East and Africa Tracing Papers Market Size and Forecast, by Type (2023-2030)

11.1.1. Cellulose Fiber Tracing Paper

11.1.2. Cotton Fiber Tracing Paper

11.2. Middle East and Africa Market Size and Forecast, by Application (2023-2030)

11.2.1. Institutional Use

11.2.2. Commercial Use

11.3. Middle East and Africa Tracing Papers Market Size and Forecast, by Country (2023-2030)

11.3.1. South Africa

11.3.2. GCC

11.3.3. Egypt

11.3.4. Nigeria

11.3.5. Rest of ME&A

12. South America Tracing Papers Market Size and Forecast (by Value Units)

12.1. South America Tracing Papers Market Size and Forecast, by Type (2023-2030)

12.1.1. Cellulose Fiber Tracing Paper

12.1.2. Cotton Fiber Tracing Paper

12.2. South America Market Size and Forecast, by Application (2023-2030)

12.2.1. Institutional Use

12.2.2. Commercial Use

12.3. South America Tracing Papers Market Size and Forecast, by Country (2023-2030)

12.3.1. Brazil

12.3.2. Argentina

12.3.3. Rest of South America

13. Company Profile: Key players

13.1. Nippon Paper Industries Co., Ltd.

13.1.1. Company Overview

13.1.2. Financial Overview

13.1.3. Business Portfolio

13.1.4. SWOT Analysis

13.1.5. Business Strategy

13.1.6. Recent Developments

13.2. Groupe Hamelin

13.3. Mitsubishi Group

13.4. Hyderabad Reprographics Pvt. Ltd.

13.5. Asian Reprographics Private Limited

13.6. ArjoWiggins Chartham

13.7. Zhejiang Wuxing Paper

13.8. Koehler Paper Group

13.9. Asia Pulp & Paper Ltd

13.10. Pixelle Specialty Solutions

13.11. Oji Papéis Especiais LTDA

13.12. Papelesy Conversiones de México

13.13. Reflex GmbH & Co. KG

13.14. Nekoosa Coated Products LLC

13.15. Thermal Solutions International Inc

13.16. Jiangxi Five Star Paper Co. Ltd

13.17. Peters Papers

13.18. Qingdao Focus Paper Co. Ltd

13.19. Mitsubishi HiTec Paper Europe GmbH

13.20. FILA-ARCHES sas

14. Key Findings

15. Industry Recommendation