Tunnel Automation Market: Global Industry Analysis and Forecast (2024-2030)

The Tunnel Automation Market size was valued at USD 4.2 Bn. in 2023. Global Tunnel Automation revenue is expected to grow at a CAGR of 8.1% from 2024 to 2030, reaching nearly USD 7.4 Bn. by 2030.

Format : PDF | Report ID : SMR_2177

Tunnel Automation Market Overview

The tunnel automation market is rapidly evolving, driven by advancements in technology and the increasing demand for enhanced safety and operational efficiency in tunnel systems. Market research reports indicate that the adoption of automated systems in tunnels is on the rise, driven by the need for real-time monitoring, traffic management, and environmental control. The target market for tunnel automation solutions includes government infrastructure projects, private tunnel operators, and industries reliant on subterranean logistics.

Qualitative research reveals that consumer behavior in the tunnel automation market is heavily influenced by the growing emphasis on safety and energy efficiency. Stakeholders prioritize solutions that offer advanced features such as intelligent lighting, HVAC control, and robust signalization systems. These preferences are driven by the need to minimize operational disruptions and enhance the overall safety of tunnel environments. Quantitative research underscores the market's robust growth trajectory, with significant investments in infrastructure development fueling demand for tunnel automation solutions

The fastest-growing region for the tunnel automation market is Asia-Pacific, driven by substantial infrastructure investments and rapid urbanization. Countries such as China, India, and Japan are at the forefront of this growth, with numerous large-scale tunnel projects underway. For instance, China’s Belt and Road Initiative includes several ambitious tunnel constructions aimed at enhancing connectivity across the region.

- According to SMR analysis, in 2023, China completed the world's longest and deepest underwater high-speed rail tunnel in Zhejiang province, showcasing the significant advancements in tunnel automation and infrastructure development in the region.

To get more Insights: Request Free Sample Report

Tunnel Automation Market Dynamics

AC500 PLC Solutions for Enhanced Safety and Efficiency

The tunnel automation market is driven by the increasing demand for efficient, safe, and sustainable tunnel infrastructure. Advancements in technology, such as PLCs, HMIs, drives, and integrated engineering suites, have enabled the development of advanced tunnel automation solutions. Major players in the industry, including ABB, are investing heavily in this technology, collaborating with partners to develop cutting-edge solutions.

- In March 2024, the Gotthard Base Tunnel in Switzerland, the world's longest and deepest railway tunnel, implemented a comprehensive automation system from ABB, including AC500 PLCs, CP600 HMIs, and ACH580 drives. This system ensures efficient operation, safety, and sustainability of the tunnel.

The U.S. Department of Transportation's Federal Highway Administration (FHWA) has recognized the importance of tunnel automation in improving safety and efficiency. The FHWA supports research and development initiatives aimed at advancing tunnel automation technologies, such as intelligent transportation systems and advanced ventilation control.

The International Tunnelling and Underground Space Association (ITA) has identified automation and digitalization as key focus areas for improving safety, efficiency, and sustainability in tunnel infrastructure. The ITA encourages its members to adopt advanced automation technologies to enhance their operations.

As the tunnel automation market continues to evolve, it is expected to have a significant impact on the transportation industry, driving efficiency, safety, and sustainability. With the support of government agencies and industry associations, the adoption of tunnel automation technologies is likely to accelerate, transforming the way tunnel infrastructure is operated worldwide.

Overcoming Challenges in the Tunnel Automation Market

The high initial investment required for advanced automation technologies. This includes the cost of installing sensors, control systems, and communication networks. The integration of these technologies with existing infrastructure is complex and time-consuming. The need for highly skilled personnel to manage and maintain automated systems is a barrier for regions with limited access to technical expertise. Cybersecurity threats pose significant risks, as automated systems are vulnerable to hacking and data breaches. Regulatory compliance and standardization issues also add to the complexity, as different regions have varying safety and operational standards. Finally, there is the challenge of public perception and acceptance of automated systems, which influence the adoption rate of these technologies in tunnel management.

Market Trends of Tunnel Automation Market

The tunnel automation market has experienced significant growth driven by trends and technological advancements. Urbanization and infrastructure development are key factors, leading to increased demand for advanced automation solutions in tunnels to ensure safety and efficiency. Integrating the Internet of Things (IoT) and cloud technologies is revolutionizing tunnel management, enabling real-time monitoring and predictive maintenance, which enhances traffic flow and security while minimizing downtime.

- For instance, Femern A/S and Sice-Cobra signed a contract for the Fehmarnbelt tunnel, involving electromechanical installations for ventilation, lighting, and safety systems. Companies like Siemens and ABB are leading the market with comprehensive solutions that integrate advanced automation technologies.

The tunnel automation market is poised for substantial growth, with a focus on enhancing operational efficiency, and safety and leveraging advanced technologies to meet the evolving infrastructure needs.

- In April 2022, Webuild and its Swiss subsidiary CSC Costruzioni successfully completed the test run of a robot called AXEL (Autonomous Exploration Electrified Vehicle), a prototype based on avantgarde technology to improve the safety of workers involved in the excavation of the Turin-Lyon base tunnel.

Value Chain Analysis of Tunnel Automation Market

The tunnel automation market's value chain covers critical stages, starting with raw material suppliers who provide essential components like sensors, control systems, and communication devices. These materials are then used by manufacturers to develop and produce the automation hardware and software required for tunnel systems. System integrators contribute their role by assembling these components into cohesive, functional solutions tailored to specific tunnel projects. They also ensure the integration of advanced technologies such as IoT and cloud computing, which are vital for real-time monitoring and predictive maintenance.

Service providers, including maintenance and support firms, are essential for the ongoing operation and optimization of tunnel automation systems, ensuring they remain efficient and secure. Finally, end-users such as government bodies, infrastructure companies, and transportation authorities implement these automated systems to enhance tunnel safety, efficiency, and operational effectiveness. This collaborative value chain drives the growth and advancement of the tunnel automation market.

Tunnel Automation Market Segment Analysis

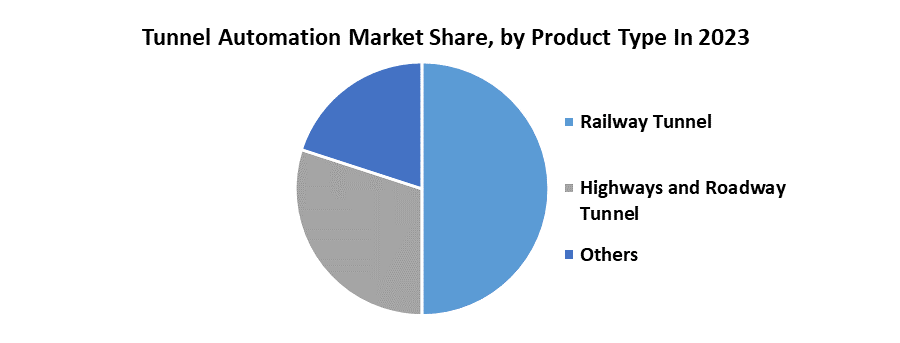

Based on the Tunnel Type, the Railway tunnels segment held the largest industry share of the Tunnel Automation Market in 2023. According to the SMR analysis, the segment is expected to grow at the highest CAGR during the forecast period and maintain its dominance till 2030. Railway tunnels are emerging as frontrunners in the tunnel automation market due to several key factors driving their demand and profitability. The increasing global emphasis on urbanization and transportation infrastructure development has spurred investments in railway networks, necessitating advanced automation solutions for efficiency and safety.

Automated systems in railway tunnels enhance operational reliability, reduce maintenance costs, and optimize energy consumption, thereby boosting profitability for operators. The growing demand for seamless passenger and freight transport further drives the adoption of automation technologies in railway tunnels, ensuring continuous operation and minimal disruptions. Stringent safety regulations and the need for real-time monitoring and control systems reinforce the market for automated solutions. These factors collectively position railway tunnels as the leading segment in the tunnel automation market, poised for sustained growth amid ongoing infrastructure modernization and expansion initiatives globally.

Tunnel Automation Market Regional Analysis

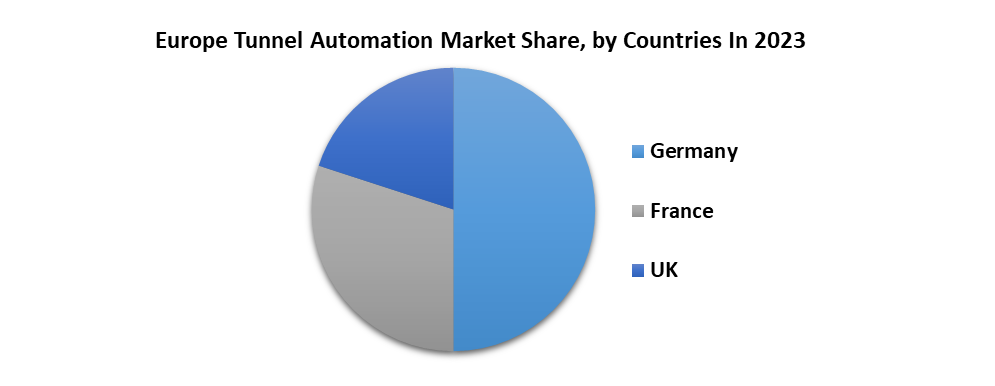

According to SMR analysis, Europe has dominated the Tunnel Automation Industry, which held the largest market share accounting for the highest market share in 2023, the region is expected to grow during the forecast period and maintain its dominance by 2030. The market is driven by extensive infrastructure development and stringent safety regulations. Countries like Germany, France, and the UK are at the forefront, investing heavily in modernizing transportation systems.

• For instance, Germany's Fehmarnbelt tunnel project, involving a €535 million contract with Femern A/S and Sice-Cobra for advanced ventilation, lighting, and safety systems, underscores this trend.

In France, significant investments in smart city projects and tunnel safety enhancements are evident. The UK's focus on integrating IoT and cloud technologies into tunnel management systems further propels market growth. Companies like Siemens and ABB dominate the market, providing holistic solutions that improve efficiency and safety in tunnels.

Europe's proactive approach to infrastructure modernization and stringent safety standards position it as a leader in the global tunnel automation market, fostering advancements and setting benchmarks for other regions.

Tunnel Automation Market Competitive Landscape

The tunnel automation market is highly competitive, with major players like Siemens AG, ABB Limited, Johnson Controls Inc., and SICK AG leading the industry. These companies focus on comprehensive automation solutions that enhance tunnel safety, efficiency, and operational control. Recent developments include Siemens’ launch of Yunex Traffic for adaptive traffic control and tunnel automation, and ABB's advancements in integrating IoT and cloud technologies into their systems. Strategic collaborations, product launches, and technological innovations are key strategies employed by these companies to maintain their market positions and drive growth.

- In Feb 2024: Siemens launched the latest version of its SCADA system for tunnel automation.

- On Jan 2023: Johnson Controls acquired Silent Aire, enhancing their HVAC and critical infrastructure solutions.

- In Jul 2023: Eaton launched a new range of power management solutions tailored for tunnel environments.

- In Oct 2022: Johnson Controls partnered with Microsoft to integrate AI-driven HVAC controls in tunnel systems.

- In Sep 2022: Honeywell unveiled an integrated tunnel monitoring system with advanced analytics

|

Tunnel Automation Market Scope |

|

|

Market Size in 2023 |

USD 4.2 Bn. |

|

Market Size in 2030 |

USD 7.4 Bn. |

|

CAGR (2024-2030) |

8.1% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

|

by Tunnel Type Railway Tunnel Highways and Roadway Tunnel Others |

|

|

by Component Lighting and Power Supply Signalization HVAC Other Components |

|

|

by Offering Hardware Software Services |

|

Regional Scope |

North America(United States), Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Recent Development

- In Mar 2024: ABB Group Introduced new energy-efficient lighting solutions for tunnels.

- In Feb 2024: Siemens launched the latest version of its SCADA system for tunnel automation.

- In Apr 2024: Trane released the next-gen HVAC system specifically designed for tunnels.

- In May 2024: Eaton acquired Green Motion SA, bolstering its electric vehicle charging infrastructure for tunnels.

- In Jun 2024: Honeywell announced the acquisition of a leading fire detection system manufacturer, enhancing its tunnel safety solutions.

Key Player in the Tunnel Automation Market

- Siemens (Germany)

- ABB Group (Switzerland)

- Johnson Controls (Ireland)

- Honeywell (USA)

- Eaton (Ireland)

- Sick AG (Germany)

- Swarco (Austria)

- Kapsch (Austria)

- Trane (USA)

- Schneider Electric (France)

- Yokogawa Electric Corporation (Japan)

- Bosch Security Systems (Germany)

- Delta Electronics (Taiwan)

- Advantech (Taiwan)

- Rockwell Automation (USA)

- Hitachi (Japan)

- Mitsubishi Electric (Japan)

- Toshiba (Japan)

- Phoenix Contact (Germany)

- Pilz GmbH & Co. KG (Germany)

- Legrand (France)

- R. Stahl (Germany)

- Alstom (France)

- Parsons Corporation (USA)

- Doka Group (Austria)

- XXX.Inc

Frequently Asked Questions

Europe is expected to hold the highest Tunnel Automation Market share.

The Tunnel Automation Market size was valued at USD 4.2 Billion in 2023 reaching nearly USD 7.4 Billion in 2030.

The significant opportunity for the global tunnel automation market lies in the increasing adoption of smart city initiatives and the expansion of urban transportation infrastructure.

The segments covered in the Tunnel Automation Market report are based on Tunnel Type, Offering, and Component.

1. Tunnel Automation Market: Research Methodology

2. Tunnel Automation Market: Executive Summary

3. Tunnel Automation Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

3.6. Global Import-Export Analysis

4. Tunnel Automation Market: Dynamics

4.1. Market Driver

4.2. Market Trends

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Strategies for New Entrants to Penetrate the Market

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Tunnel Automation Market Size and Forecast by Segments (by Value in USD Billion)

5.1. Tunnel Automation Market Size and Forecast, by Tunnel Type (2023-2030)

5.1.1. Railway Tunnel

5.1.2. Highways and Roadway Tunnel

5.1.3. Others

5.2. Tunnel Automation Market Size and Forecast, by Offering (2023-2030)

5.2.1. Hardware

5.2.2. Software

5.2.3. Services

5.3. Tunnel Automation Market Size and Forecast, by Component (2023-2030)

5.3.1. Lighting and Power Supply

5.3.2. Signalization

5.3.3. HVAC

5.3.4. Other Components

5.4. Tunnel Automation Market Size and Forecast, by Region (2023-2030)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Tunnel Automation Market Size and Forecast (by Value in USD Billion)

6.1. North America Tunnel Automation Market Size and Forecast, by Tunnel Type (2023-2030)

6.1.1. Railway Tunnel

6.1.2. Highways and Roadway Tunnel

6.1.3. Others

6.2. North America Tunnel Automation Market Size and Forecast, by Offering (2023-2030)

6.2.1. Hardware

6.2.2. Software

6.2.3. Services

6.3. North America Tunnel Automation Market Size and Forecast, by Component (2023-2030)

6.3.1. Lighting and Power Supply

6.3.2. Signalization

6.3.3. HVAC

6.3.4. Other Components

6.4. North America Tunnel Automation Market Size and Forecast, by Country (2023-2030)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Tunnel Automation Market Size and Forecast (by Value in USD Billion )

7.1. Europe Tunnel Automation Market Size and Forecast, by Tunnel Type (2023-2030)

7.1.1. Railway Tunnel

7.1.2. Highways and Roadway Tunnel

7.1.3. Others

7.2. Europe Tunnel Automation Market Size and Forecast, by Offering (2023-2030)

7.2.1. Hardware

7.2.2. Software

7.2.3. Services

7.3. Europe Tunnel Automation Market Size and Forecast, by Component (2023-2030)

7.3.1. Lighting and Power Supply

7.3.2. Signalization

7.3.3. HVAC

7.3.4. Other Components

7.4. Europe Tunnel Automation Market Size and Forecast, by Country (2023-2030)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Tunnel Automation Market Size and Forecast (by Value in USD Billion )

8.1. Asia Pacific Tunnel Automation Market Size and Forecast, by Tunnel Type (2023-2030)

8.1.1. Railway Tunnel

8.1.2. Highways and Roadway Tunnel

8.1.3. Others

8.2. Asia Pacific Tunnel Automation Market Size and Forecast, by Offering (2023-2030)

8.2.1. Hardware

8.2.2. Software

8.2.3. Services

8.3. Asia Pacific Tunnel Automation Market Size and Forecast, by Component (2023-2030)

8.3.1. Lighting and Power Supply

8.3.2. Signalization

8.3.3. HVAC

8.3.4. Other Components

8.4. Asia Pacific Tunnel Automation Market Size and Forecast, by Country (2023-2030)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Tunnel Automation Market Size and Forecast (by Value in USD Billion )

9.1. Middle East and Africa Tunnel Automation Market Size and Forecast, by Tunnel Type (2023-2030)

9.1.1. Railway Tunnel

9.1.2. Highways and Roadway Tunnel

9.1.3. Others

9.2. Middle East and Africa Tunnel Automation Market Size and Forecast, by Offering (2023-2030)

9.2.1. Hardware

9.2.2. Software

9.2.3. Services

9.3. Middle East and Africa Tunnel Automation Market Size and Forecast, by Component (2023-2030)

9.3.1. Lighting and Power Supply

9.3.2. Signalization

9.3.3. HVAC

9.3.4. Other Components

9.4. Middle East and Africa Single-Use Filtration Assembly Market Size and Forecast, by Country (2023-2030)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Tunnel Automation Market Size and Forecast (by Value in USD Billion )

10.1. South America Tunnel Automation Market Size and Forecast, by Tunnel Type (2023-2030)

10.1.1. Railway Tunnel

10.1.2. Highways and Roadway Tunnel

10.1.3. Others

10.2. South America Tunnel Automation Market Size and Forecast, by Offering (2023-2030)

10.2.1. Hardware

10.2.2. Software

10.2.3. Services

10.3. South America Tunnel Automation Market Size and Forecast, by Component (2023-2030)

10.3.1. Lighting and Power Supply

10.3.2. Signalization

10.3.3. HVAC

10.3.4. Other Components

10.4. South America Tunnel Automation Market Size and Forecast, by Country (2023-2030)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. Siemens (Germany)

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. ABB Group (Switzerland)

11.3. Johnson Controls (Ireland)

11.4. Honeywell (USA)

11.5. Eaton (Ireland)

11.6. Sick AG (Germany)

11.7. Swarco (Austria)

11.8. Kapsch (Austria)

11.9. Trane (USA)

11.10. Schneider Electric (France)

11.11. Yokogawa Electric Corporation (Japan)

11.12. Bosch Security Systems (Germany)

11.13. Delta Electronics (Taiwan)

11.14. Advantech (Taiwan)

11.15. Rockwell Automation (USA)

11.16. Hitachi (Japan)

11.17. Mitsubishi Electric (Japan)

11.18. Toshiba (Japan)

11.19. Phoenix Contact (Germany)

11.20. Pilz GmbH & Co. KG (Germany)

11.21. Legrand (France)

11.22. R. Stahl (Germany)

11.23. Alstom (France)

11.24. Parsons Corporation (USA)

11.25. Doka Group (Austria)

11.26. XXX.Inc

12. Key Findings

13. Industry Recommendations