US Laptop Market: Industry Analysis and Forecast (2024-2030)

The US Laptop Market size was valued at USD 19.8 Bn. in 2023 and the total US Laptop revenue is expected to grow at a CAGR of 2.17% from 2024 to 2030, reaching nearly USD 23.01 Bn. in 2030.

Format : PDF | Report ID : SMR_2096

US Laptop Market Overview-

The US laptop market experiences robust growth which is driven by widespread high-speed internet adoption and the surge in multipurpose laptops. Increased consumer demand, coupled with expanded usage in education and BYOD (Bring your Own Device) trends in businesses are key drivers of the market. This convergence is propelling the United States laptop market forward, emphasizing versatility and connectivity as pivotal factors in shaping consumer choices and industry dynamics.

- The United States exports most of its laptop computers to Costa Rica, Ecuador, and Peru, ranking as the world's third-largest exporter of laptops.

- China leads in laptop exports with 542,413 shipments, followed by Vietnam with 14,462, and the United States in third place with 12,238 shipments.

This research report delves into the evolving US laptop market, offering actionable insights for stakeholders. It examines trends, technological advancements, and potential disruptions, evaluating market size, growth, economic variables, regulations, and business drivers. The competitive landscape analysis underscores key players' differentiation strategies. In response to economic challenges, the report aims to equip government agencies, policymakers, and tech firms with vital data to foster informed decision-making in this sector.

To get more Insights: Request Free Sample Report

US Laptop Market Dynamics:

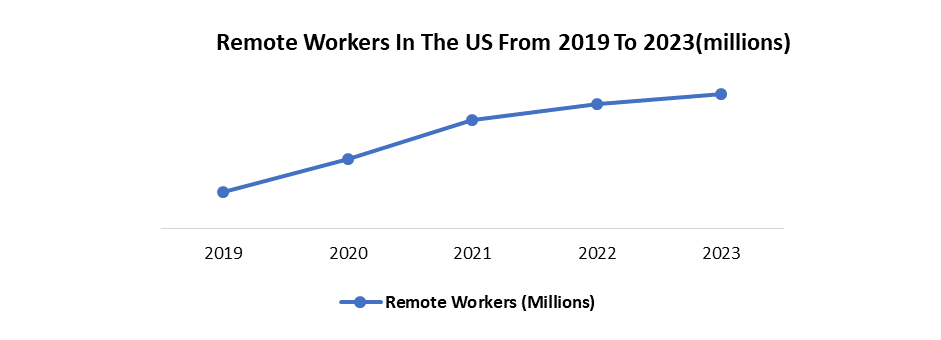

Growth of the Remote Work Trend to drive the US Laptop Market

The surge in remote work is driving the US laptop market. Laptops offer essential mobility and flexibility, vital for remote work's demands. Unlike desktops, they enable work from anywhere with internet access, enhancing productivity and convenience. This shift underscores laptops as indispensable tools and driving substantial market growth amid evolving work trends.

The rise in remote and hybrid work models has spurred increased demand for laptops across the US. Companies and individuals are seeking essential tools to support their work-from-anywhere needs and driving substantial market growth. This surge underscores laptops as indispensable assets in today's evolving work landscape, fueling US laptop market growth in response to heightened demand.

Laptop manufacturers are adapting to the remote work trend by enhancing their products. Key features such as extended battery life, robust processors for seamless video conferencing, and durable designs suited for frequent travel are now prioritized. This responsive approach not only meets current market demands but also positions laptops as essential tools for remote work, driving their significance in the evolving marketplace.

The shift to remote work diminishes the practicality of desktops, amplifying the necessity for laptops. Their portability and functionality cater perfectly to productive work outside traditional office confines. Accordingly, laptops transition from being desirable to indispensable tools in this evolving landscape. This transformation significantly boosts the US laptop market, driving both heightened demand and innovation in features offered by manufacturers to meet the new work environment's demands.

US Laptop Market Segment Analysis.

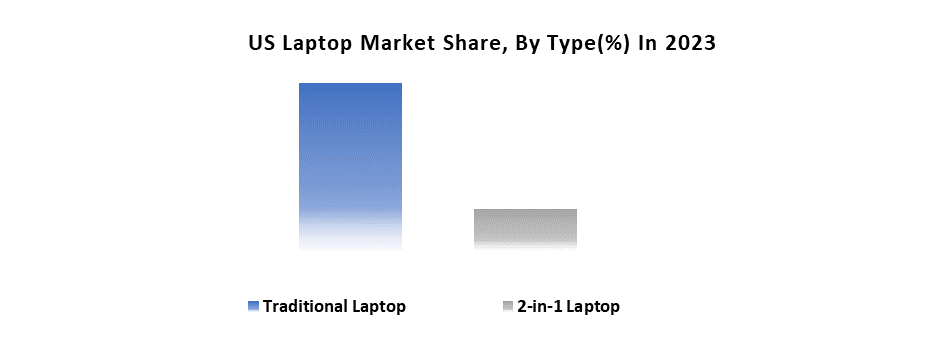

Based on Type, the Traditional Laptop segment held the largest market share of about 60% in the US Laptop Market in 2023. According to the STELLAR analysis, the segment is further expected to grow at a CAGR of 2.17% during the forecast period. The US Laptop Market asserts dominance through rapid technological advancements and widespread adoption of smart devices with seamless data connectivity. This segment stands out thanks to its progressive integration, catering to evolving consumer needs for interconnectedness and efficiency.

The traditional laptop maintains its stronghold in the US market, commanding significant market share despite the rise of newer designs such as 2-in-1 laptops. Renowned for reliability and versatility traditional laptops cater to diverse consumer needs from business professionals to students. They offer robust performance, ample storage, and varied configurations, ensuring they remain indispensable for intensive tasks like gaming and content creation. Their enduring popularity underscores a preference for familiar, proven technology amidst evolving trends. As the market adapts to innovations, traditional laptops continue to define the standard, balancing functionality with enduring appeal and widespread utility.

The US laptop market sees significant growth driven by ongoing demand for traditional laptops, particularly in commercial and gaming sectors. The shift towards remote work amplifies this trend, emphasizing the necessity for portable, robust devices. Continuous innovation in processors, SSDs, and displays further enhances traditional laptops' competitiveness and relevance. Manufacturers' commitment to advancing these technologies ensures that traditional laptops remain pivotal in meeting diverse consumer needs for performance, durability, and versatility. As these devices evolve to accommodate modern workflows and entertainment demands, they reinforce their position as indispensable tools in both professional and personal computing landscapes.

Traditional laptops offer versatility across budgets and needs, serving students, professionals, and casual users with various configurations. They excel in performance for intensive tasks like video editing and gaming, thanks to superior cooling and robust components. Their standardized design provides a familiar, cost-effective computing experience compared to 2-in-1s.

US Laptop Market Scope:

|

US Laptop Market |

|

|

Market Size in 2023 |

USD 19.8 Billion |

|

Market Size in 2030 |

USD 23.01 Billion |

|

CAGR (2024-2030) |

2.17 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope

|

By Type

|

|

By Application

|

|

Leading Key Players in the US Laptop Market

Frequently Asked Questions

Increasing Popularity of Smartphones and Tablets are expected to be the major restraining factors for the US Laptop market growth.

The US Laptop Market size was valued at USD 19.8 Billion in 2023 and the total US Laptop revenue is expected to grow at a CAGR of 2.17% from 2024 to 2030, reaching nearly USD 23.01 Billion by 2030.

1. US Laptop Market Introduction

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Executive Summary

1.4 Emerging Technologies

1.5 Market Projections

1.6 Strategic Recommendations

2. US Laptop Market Import Export Landscape

2.1 Import Trends

2.2 Export Trends

2.3 Regulatory Compliance

2.4 Major Export Destinations

2.5 Import-Export Disparities

3. US Laptop Market: Dynamics

3.1.1 Market Drivers

3.1.2 Market Restraints

3.1.3 Market Opportunities

3.1.4 Market Challenges

3.2 PORTER’s Five Forces Analysis

3.3 PESTLE Analysis

3.4 Regulatory Landscape

3.5 Analysis of Government Schemes and Initiatives for the US Laptop Industry.

4. US Laptop Market: Market Size and Forecast by Segmentation (Value) (2023-2030)

4.1 US Laptop Market Size and Forecast, By Type (2023-2030)

4.1.1 Traditional Laptop

4.1.2 2-in-1 Laptop

4.2 US Laptop Market Size and Forecast, By Application (2023-2030)

4.2.1 Personal

4.2.2 Gaming

4.2.3 Business

5. US Laptop Market: Competitive Landscape

5.1 Stellar Competition Matrix

5.2 Competitive Landscape

5.3 Key Players Benchmarking

5.3.1 Company Name

5.3.2 Service Segment

5.3.3 End-user Segment

5.3.4 Revenue (2023)

5.3.5 Company Locations

5.4 Leading US Laptop Companies, by market capitalization

5.5 Market Structure

5.5.1 Market Leaders

5.5.2 Market Followers

5.5.3 Emerging Players

5.6 Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1 Razer Inc.

6.1.1 Company Overview

6.1.2 Business Portfolio

6.1.3 Financial Overview

6.1.4 SWOT Analysis

6.1.5 Strategic Analysis

6.1.6 Scale of Operation (small, medium, and large)

6.1.7 Details on Partnership

6.1.8 Regulatory Accreditations and Certifications Received by Them

6.1.9 Awards Received by the Firm

6.1.10 Recent Developments

6.2 Apple

6.3 HP

6.4 Dell

6.5 Alienware

6.6 Google

6.7 Microsoft

6.8 Origin PC Corp

6.9 Others

7. Key Findings

8. Industry Recommendations

9. Terms and Glossary

10. US Laptop Market: Research Methodology