Uninterruptible Power Supply Market: Global Industry Analysis and Forecast (2024-2030)

Uninterruptible Power Supply Market size was valued at USD 7.98 Bn. in 2023 and the Uninterruptible Power Supply revenue is expected to grow at a CAGR of 4.86 % from 2024 to 2030, reaching nearly USD 11.12 Bn. by 2030.

Format : PDF | Report ID : SMR_2129

Uninterruptible Power Supply Market Overview:

Data centres require reliable power protection to ensure uninterrupted operation and prevent data loss, making UPS systems essential for maintaining business continuity in the event of power disruptions. Also, the widespread adoption of IT infrastructure across various industries, including telecommunications, banking, healthcare, and e-commerce, is fueling the demand for UPS solutions. As organizations become increasingly dependent on digital technologies and electronic systems, the need to safeguard critical equipment from power disturbances and outages is propelling the deployment of UPS systems.

UPS systems typically incorporate a battery that stores electrical energy and automatically switches to battery power when it detects a loss or disturbance in the main power. UPS units are widely used in various applications, such as data centers, hospitals, telecommunications, and home electronics, to safeguard against power interruptions and protect sensitive equipment from damage.

North America is expected to dominate the market due to the increasing investment in high-content screening. The U.S. is expected to dominate the North America region due to the strong presence of key players.

To get more Insights: Request Free Sample Report

Uninterruptible Power Supply Market Dynamics:

Growing Demand and Trends Propel Uninterruptible Power Supply (UPS) Market Expansion

The drivers of the Uninterruptible Power Supply (UPS) market include the increasing demand for reliable and uninterrupted power supply, the rising adoption of cloud-based services, and the growing use of electronic devices in various sectors. The need for protecting sensitive equipment and preventing data loss due to power disruptions is also driving the demand for UPS systems. Furthermore, the growth of e-commerce and the expanding data centre industry are fuelling the demand for UPS units.

Additionally, the increasing use of renewable energy sources and the need for energy-efficient solutions are creating opportunities for the development of advanced and eco-friendly UPS systems. the demand for robust and reliable UPS systems has surged, as data centre operators strive to safeguard their infrastructure, maintain service uptime, and adhere to business continuity standards. This trend aligns with the need for enhanced power management, energy efficiency, and resilience in the rapidly evolving digital landscape.

Complexity, Space Constraints, and Compatibility Issues

The global uninterruptible power supply (UPS) market encounters various challenges arising from technological intricacies, space limitations, and compatibility issues. As UPS systems evolve to meet higher efficiency and capacity demands, they become increasingly complex. Incorporating features like modular architectures, energy storage solutions, and advanced monitoring capabilities adds layers of sophistication to system design and deployment.

This complexity may elevate initial costs, necessitate specialized skills for setup and upkeep, and could potentially disrupt seamless integration with existing data center infrastructures, posing obstacles to widespread adoption. Moreover, the allocation of physical space for UPS units poses a critical concern as data centers seek to optimize computing density to accommodate expanding workloads. Larger or bulkier UPS systems can encroach on valuable floor space, potentially impacting overall facility efficiency and capacity.

Uninterruptible Power Supply Market Segment Analysis:

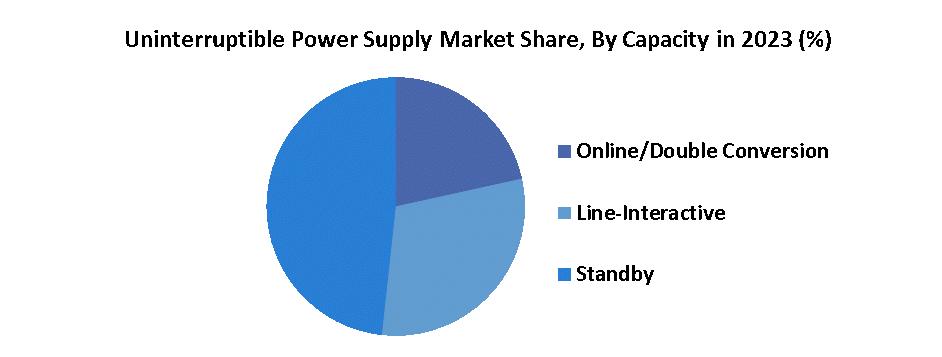

By Type, the uninterruptible power supply (UPS) market is segmented primarily by type into three categories: offline/standby UPS, line-interactive UPS, and online/double-conversion UPS. Offline/standby UPS systems are cost-effective solutions providing basic protection. Line-interactive UPS systems offer enhanced voltage regulation and battery backup, suited for small to medium-sized businesses. Online/double-conversion UPS systems provide the highest level of protection, continuously converting AC to DC and back to AC, ensuring clean power delivery. Each type caters to different needs in terms of cost, reliability, and the criticality of uninterrupted power supply, driving their adoption across various sectors globally.

Uninterruptible Power Supply Market Regional Insight:

The global uninterruptible power supply (UPS) market is studied across different regions like North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America accounted for the major share of the global market due to the rise in automation In Insurance, healthcare, and financial services. The North American Market Is also increasing due to the growing telecommunication and cloud-based services in the U.S. and Canada.

Asia-Pacific is the fastest-growing region for the global uninterruptible power supply market, owing to the rising number of collaborative data centres in developing nations such as India and China. The exponential rise in population has led to the expansion of power, manufacturing, food and beverages, and all other industries in the region which has directly increased the demand for uninterrupted power supply and therefore UPS. Europe and the Middle East and Africa are steady growing regions due to a rise in automation and cloud services in manufacturing and processing industries.

Uninterruptible Power Supply Competitive Landscape:

- In July 2023, ABB India's Electrification business launched the MegaFlex DPA UPS solution, a sustainable and innovative product for data centers in the Indian market. The UPS offers a reliable and scalable power solution for the growing demand in the data center industry with its reduced footprint, high energy efficiency, and compliance with circularity frameworks

- In May 2023, Delta Electronics, Inc. and IPD joined forces for the distribution of uninterruptible power supplies (UPS) in Australia, enabling IPD to expand its product portfolio and provide comprehensive solutions across various industries. Delta's UPS systems, known for their innovative and intelligent technology, will enhance reliability and efficiency for customers in the Australian market

Uninterruptible Power Supply Market Scope:

|

Uninterruptible Power Supply Market |

|

|

Market Size in 2023 |

USD 7.98 Bn. |

|

Market Size in 2030 |

USD 11.12 Bn. |

|

CAGR (2024-2030) |

4.86 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Type On-Line Double-Conversion Line Interactive Passive Standby |

|

By Battery Type VRLA UPS Lithium-Ion UPS Flywheel Ups Others |

|

|

By Application Cloud Storage Data Warehouse Erp System File Server Application Servers Crm Systems Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Uninterruptible Power Supply Market Key Players:

- Riello Elettronica S.P.A.

- EATON Corporation PLC

- Emerson Electric Co.

- Delta Electronics Inc.

- ABB Ltd

- Schneider Electric SE

- Hitachi Ltd

- Mitsubishi Electric Corporation

- General Electric Company

- Cyber Power Systems Inc.

- Aspex Inc.

- Baykee New Energy Technology Incorporated Co., Ltd

- Toshiba

- Gamatronic UK Limited

- Active Power

- Zhongshan HongBao Electric Co. Ltd.

- S&C Electric Company

- Guangdong Zhicheng Champion Group Co., Ltd

- Jiangsu Meibaijia Electrical Manufacturing Co., Ltd.

- AEG Power Solutions.

Frequently Asked Questions

Complexity, Space Constraints, and Compatibility Issues are the challenge in the Uninterruptible Power Supply Market.

The Market size was valued at USD 7.98 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 4.86 % from 2024 to 2030, reaching nearly USD 11.12 Billion.

The segments covered in the market report are by Battery Type, By Capacity, and By Application.

1. Uninterruptible Power Supply Market: Research Methodology

2. Uninterruptible Power Supply Market: Executive Summary

3. Uninterruptible Power Supply Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Uninterruptible Power Supply Market Import Export Landscape

5.1. Import Trends

5.2. Export Trends

5.3. Regulatory Compliance

5.4. Major Export Destinations

5.5. Import-Export Disparities

6. Uninterruptible Power Supply Market: Dynamics

6.1. Market Trends by Region

6.1.1. North America

6.1.2. Europe

6.1.3. Asia Pacific

6.1.4. Middle East and Africa

6.1.5. South America

6.2. Market Drivers by Region

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East and Africa

6.2.5. South America

6.3. Market Restraints

6.4. Market Opportunities

6.5. Market Challenges

6.6. PORTER’s Five Forces Analysis

6.7. PESTLE Analysis

6.8. Strategies for New Entrants to Penetrate the Market

6.9. Regulatory Landscape by Region

6.9.1. North America

6.9.2. Europe

6.9.3. Asia Pacific

6.9.4. Middle East and Africa

6.9.5. South America

7. Uninterruptible Power Supply Market Size and Forecast by Segments (by Value Units)

7.1. Uninterruptible Power Supply Market Size and Forecast, by Type (2023-2030)

7.1.1. On-Line Double-Conversion

7.1.2. Line Interactive

7.1.3. Passive Standby

7.2. Uninterruptible Power Supply Market Size and Forecast, by Battery Type (2023-2030)

7.2.1. VRLA UPS

7.2.2. Lithium-Ion UPS

7.2.3. Flywheel Ups

7.2.4. Others

7.3. Uninterruptible Power Supply Market Size and Forecast, by Application (2023-2030)

7.3.1. Cloud Storage

7.3.2. Data Warehouse

7.3.3. Erp System

7.3.4. File Server

7.3.5. Application Servers

7.3.6. Crm Systems

7.3.7. Others

7.4. Uninterruptible Power Supply Market Size and Forecast, by Region (2023-2030)

7.4.1. North America

7.4.2. Europe

7.4.3. Asia Pacific

7.4.4. Middle East and Africa

7.4.5. South America

8. North America Uninterruptible Power Supply Market Size and Forecast (by Value Units)

8.1. North America Uninterruptible Power Supply Market Size and Forecast, by Type (2023-2030)

8.1.1. On-Line Double-Conversion

8.1.2. Line Interactive

8.1.3. Passive Standby

8.2. Uninterruptible Power Supply Market Size and Forecast, by Battery Type (2023-2030)

8.2.1. VRLA UPS

8.2.2. Lithium-Ion UPS

8.2.3. Flywheel Ups

8.2.4. Others

8.3. Uninterruptible Power Supply Market Size and Forecast, by Application (2023-2030)

8.3.1. Cloud Storage

8.3.2. Data Warehouse

8.3.3. Erp System

8.3.4. File Server

8.3.5. Application Servers

8.3.6. Crm Systems

8.3.7. Others

8.4. North America Uninterruptible Power Supply Market Size and Forecast, by Country (2023-2030)

8.4.1. United States

8.4.2. Canada

8.4.3. Mexico

9. Europe Uninterruptible Power Supply Market Size and Forecast (by Value Units)

9.1. Europe Uninterruptible Power Supply Market Size and Forecast, by Type (2023-2030)

9.1.1. On-Line Double-Conversion

9.1.2. Line Interactive

9.1.3. Passive Standby

9.2. Uninterruptible Power Supply Market Size and Forecast, by Battery Type (2023-2030)

9.2.1. VRLA UPS

9.2.2. Lithium-Ion UPS

9.2.3. Flywheel Ups

9.2.4. Others

9.3. Uninterruptible Power Supply Market Size and Forecast, by Application (2023-2030)

9.3.1. Cloud Storage

9.3.2. Data Warehouse

9.3.3. Erp System

9.3.4. File Server

9.3.5. Application Servers

9.3.6. Crm Systems

9.3.7. Others

9.4. Europe Uninterruptible Power Supply Market Size and Forecast, by Country (2023-2030)

9.4.1. UK

9.4.2. France

9.4.3. Germany

9.4.4. Italy

9.4.5. Spain

9.4.6. Sweden

9.4.7. Russia

9.4.8. Rest of Europe

10. Asia Pacific Uninterruptible Power Supply Market Size and Forecast (by Value Units)

10.1. Asia Pacific Uninterruptible Power Supply Market Size and Forecast, by Type (2023-2030)

10.1.1. On-Line Double-Conversion

10.1.2. Line Interactive

10.1.3. Passive Standby

10.2. Uninterruptible Power Supply Market Size and Forecast, by Battery Type (2023-2030)

10.2.1. VRLA UPS

10.2.2. Lithium-Ion UPS

10.2.3. Flywheel Ups

10.2.4. Others

10.3. Uninterruptible Power Supply Market Size and Forecast, by Application (2023-2030)

10.3.1. Cloud Storage

10.3.2. Data Warehouse

10.3.3. Erp System

10.3.4. File Server

10.3.5. Application Servers

10.3.6. Crm Systems

10.3.7. Others

10.4. Asia Pacific Air Traffic Control (ATC) Communications Market Size and Forecast, by Country (2023-2030)

10.4.1. China

10.4.2. S Korea

10.4.3. Japan

10.4.4. India

10.4.5. Australia

10.4.6. Indonesia

10.4.7. Malaysia

10.4.8. Vietnam

10.4.9. Taiwan

10.4.10. Bangladesh

10.4.11. Pakistan

10.4.12. Rest of Asia Pacific

11. Middle East and Africa Uninterruptible Power Supply Market Size and Forecast (by Value Units)

11.1. Middle East and Africa Uninterruptible Power Supply Market Size and Forecast, by Type (2023-2030)

11.1.1. On-Line Double-Conversion

11.1.2. Line Interactive

11.1.3. Passive Standby

11.2. Middle East and Africa Market Size and Forecast, by Battery Type (2023-2030)

11.2.1. VRLA UPS

11.2.2. Lithium-Ion UPS

11.2.3. Flywheel Ups

11.2.4. Others

11.3. Uninterruptible Power Supply Market Size and Forecast, by Application (2023-2030)

11.3.1. Cloud Storage

11.3.2. Data Warehouse

11.3.3. Erp System

11.3.4. File Server

11.3.5. Application Servers

11.3.6. Crm Systems

11.3.7. Others

11.4. Middle East and Africa Uninterruptible Power Supply Market Size and Forecast, by Country (2023-2030)

11.4.1. South Africa

11.4.2. GCC

11.4.3. Egypt

11.4.4. Nigeria

11.4.5. Rest of ME&A

12. South America Uninterruptible Power Supply Market Size and Forecast (by Value Units)

12.1. South America Uninterruptible Power Supply Market Size and Forecast, by Type (2023-2030)

12.1.1. On-Line Double-Conversion

12.1.2. Line Interactive

12.1.3. Passive Standby

12.2. South America Market Size and Forecast, by Battery Type (2023-2030)

12.2.1. VRLA UPS

12.2.2. Lithium-Ion UPS

12.2.3. Flywheel Ups

12.2.4. Others

12.3. Uninterruptible Power Supply Market Size and Forecast, by Application (2023-2030)

12.3.1. Cloud Storage

12.3.2. Data Warehouse

12.3.3. Erp System

12.3.4. File Server

12.3.5. Application Servers

12.3.6. Crm Systems

12.3.7. Others

12.4. South America Uninterruptible Power Supply Market Size and Forecast, by Country (2023-2030)

12.4.1. Brazil

12.4.2. Argentina

12.4.3. Rest of South America

13. Company Profile: Key players

13.1. 1. Riello Elettronica S.P.A.

13.1.1.1. Company Overview

13.1.1.2. Financial Overview

13.1.1.3. Business Portfolio

13.1.1.4. SWOT Analysis

13.1.1.5. Business Strategy

13.1.1.6. Recent Developments

13.2. EATON Corporation PLC

13.3. Emerson Electric Co.

13.4. Delta Electronics Inc.

13.5. ABB Ltd

13.6. Schneider Electric SE

13.7. Hitachi Ltd

13.8. Mitsubishi Electric Corporation

13.9. General Electric Company

13.10. Cyber Power Systems Inc.

13.11. Aspex Inc.

13.12. Baykee New Energy Technology Incorporated Co., Ltd

13.13. Toshiba

13.14. Gamatronic UK Limited

13.15. Active Power

13.16. Zhongshan HongBao Electric Co. Ltd.

13.17. S&C Electric Company

13.18. Guangdong Zhicheng Champion Group Co., Ltd

13.19. Jiangsu Meibaijia Electrical Manufacturing Co., Ltd.

13.20. AEG Power Solutions.

14. Key Findings

15. Industry Recommendation