Waterproofing Admixtures Market: Global Industry Analysis and Forecast (2024-2030)

The Waterproofing Admixtures Market size was valued at USD 4.83 Bn. in 2023 and the total Waterproofing Admixtures Market size is expected to grow at a CAGR of 7.86% from 2024 to 2030, reaching nearly USD 8.20 Bn. by 2030.

Format : PDF | Report ID : SMR_2155

Waterproofing Admixtures Market Overview

Waterproofing admixtures are specialized chemicals added to concrete or mortar during the mixing process to enhance its resistance to water ingress. They minimize the porosity and permeability of concrete, preventing water and other liquids from penetrating through its surface or capillary pores. These admixtures are crucial in structures where water resistance is essential, such as basements, swimming pools, storage tanks, and maritime constructions. The assumption of waterproofing admixtures is a basic part of the sustainability equation, contributing to the growth of robust, durable, and long-lasting infrastructure.

The market growth of waterproofing admixtures is driven by increased construction and infrastructure development activities globally, stringent building codes and regulations, and stringent regulations on carbon emissions and environmental sustainability. Waterproofing admixtures are used in various applications, including building & construction, public infrastructure, and commercial space. The market growth is driven by the rise in infrastructure requirements in developing economies, improving construction industries, and increased urbanization.

To get more Insights: Request Free Sample Report

Waterproofing Admixtures Market Dynamics:

The increasing urbanization is expected to drive the global waterproofing admixtures market, as it leads to increased demand for infrastructure development, such as roads, bridges, tunnels, and buildings. These structures involve reliable waterproofing resolutions to protect them from water damage and spread their lifespan. Waterproofing admixtures, made from hydrophobic or water-repellent substances from cleansers, vegetable oils, unsaturated fats, and petrol, are commonly used to waterproof concrete. These substances create a covering that keeps water out of pores and protects the building from dampness.

Water-added substances are also used in foundations, businesses, and private areas to increase the building's elasticity and lifespan. They also help prevent mold development caused by dampness and water drainage. Integral waterproofing offers enhanced durability during backfill, and resistance to delamination, and decomposition. The need for waterproofing additives is increased by new construction, maintenance, and repair projects. Over the projected period, these factors are help drive market growth by growing the function of waterproofing admixtures.

The lack of awareness and education about waterproofing admixtures among property owners and the construction industry is a major difficulty in their acceptance. Only XX% of construction professionals regularly incorporate these materials into their projects, according to a survey. This incomplete market awareness restrains the waterproofing admixtures market. Maintaining product consistency and performance is a complex difficulty for manufacturers, as construction projects become more demanding and diverse. The main challenge lies in adopting variations in manufacturing processes, sourcing raw materials, and external factors that impact product quality. Therefore, ensuring product consistency and performance remains a major issue for the waterproofing admixtures market.

The advancement of 3D printing technology in the construction industry presents significant opportunities for the waterproofing admixture market. This technology allows for the construction of intricate and customized structures, presenting new challenges in ensuring long-term durability and waterproofing. Waterproofing admixtures play a crucial role in improving the resilience of 3D-printed structures by averting water diffusion and potential damage. As these innovations advance, the demand for effective waterproofing solutions is likely to grow, presenting a promising avenue for the continued growth of the waterproofing admixture industry.

The market's growth is driven by the construction industry's growing need for waterproof products like capillary absorption, concrete sealers, and pore blocking. Additives protect buildings from deterioration, increase concrete cohesiveness, and save maintenance costs. Customers are also becoming more aware of the benefits of waterproofing admixtures, reducing the financial burden on builders and customers.

Waterproofing Admixtures Market Segment Analysis:

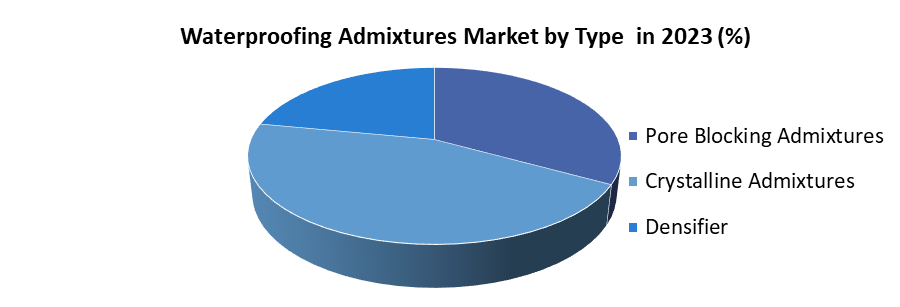

Based on Type, The market was dominated by the crystalline admixtures segment in 2023. Because of their effectiveness and adaptability in preventing water from penetrating concrete, glasslike admixtures are growing increasingly common in a variety of initiatives. Also, they maintain their substance action within the substantial and partially plug newly formed holes.

Application, the residential segment produced the highest revenue in 2023 because of a range of factors. The constant requirement for waterproofing plans stems from the growth of private buildings, which is a result of increasing urbanization and demand for lodging. Widespread use of waterproofing admixtures is driven by mortgage holders' growing awareness of the products' long-term advantages, which include protecting properties against leaks, condensation, and accumulation.

Waterproofing Admixtures Market Regional Insight:

The Asia-Pacific region is experiencing the rapid growth potential in the waterproofing admixture market, with countries like China, India, and Japan leading the construction boom because of rapid urbanization, infrastructure development, and increased governmental investments. The high prevalence of humid and rainy climates in the region fuels the demand for effective waterproofing solutions. China, the largest economy in the region, and India are among the fastest emerging economies in the world. The construction industry in the Asia-Pacific is expected to become the largest and fastest-growing globally, with over XX% share of global construction spending coming from the region.

Waterproofing Admixtures Market Competitive Landscape:

- On 06/12/2024, Sika opened a new plant in Liaoning, the largest province in northeastern China. This site manufactures a full range of products, including mortars, tile adhesives, and waterproofing solutions. This highly efficient new plant enables Sika to meet the market demands, whilst significantly reducing logistical distances.

- April 3, 2024, Saint-Gobain announces that it has entered into a definitive agreement for the acquisition of The Bailey Group Companies consisting of Bailey-Hunt Limited and its subsidiaries a privately owned manufacturer of metal building solutions for light construction in Canada, for C$880 million (approximately €600 million) in cash.

- May 25, 2024, Fosroc India is proud to announce the inauguration of its new, integrated Construction Chemicals Plant in Hyderabad. This cutting-edge facility is strategically designed to enhance service levels and extend geographical coverage, across South and Central INDIA.

|

Waterproofing Admixtures Market Scope |

|

|

Market Size in 2023 |

USD 4.83 Bn. |

|

Market Size in 2030 |

USD 8.20 Bn. |

|

CAGR (2024-2030) |

7.86 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Type Pore Blocking Admixtures Crystalline Admixtures Densifier |

|

By Application Residential Commercial Infrastructure |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Waterproofing Admixtures Market

- Saint-Gobain S.A - France

- Mapei S.p.A. - Italy

- Fosroc, Inc. - United Kingdom

- Penetron - United States

- Xypex Chemical Corporation - Canada

- RPM International Inc. - United States

- CEMEX S.A.B. de C.V. – Mexico

- Sika AG - Switzerland

- BASF - Germany

- Pidilite Industries Limited - India

- Wacker Chemie AG - Germany

- Dr Fixit - India

- Hard And Shine Chemicals - India

- U.S. Waterproofing - United States

- MUHU - China

- Ardex Endura - Germany

- Berger - India

- Sunanda Global – India

- XX.inc

Frequently Asked Questions

Asia-Pacific is expected to lead the Waterproofing Admixtures Market during the forecast period.

An analysis of profit trends and projections for companies in the Waterproofing Admixtures Market is included, offering insights into factors driving profitability, cost management strategies, and financial performance metrics.

The Waterproofing Admixtures Market size was valued at USD 4.83 Billion in 2023 and the total Waterproofing Admixtures Market size is expected to grow at a CAGR of 7.86% from 2024 to 2030, reaching nearly USD 8.20 Billion by 2030.

The segments covered in the market report are by Type, and by Application.

1. Waterproofing Admixtures Market: Research Methodology

2. Waterproofing Admixtures Market: Executive Summary

3. Waterproofing Admixtures Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

4.6. Import and export of Waterproofing Admixtures Market

5. Waterproofing Admixtures Market : Dynamics

5.1. Market Driver

5.1.1. Increasing Consumer Awareness

5.1.2. Innovation in Product Offerings

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers by Region

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Waterproofing Admixtures Market Size and Forecast by Segments (by value Units)

6.1. Waterproofing Admixtures Market Size and Forecast, by Type (2023-2030)

6.1.1. Pore Blocking Admixtures

6.1.2. Crystalline Admixtures

6.1.3. Densifier

6.2. Waterproofing Admixtures Market Size and Forecast, by Application (2023-2030)

6.2.1. Residential

6.2.2. Commercial

6.2.3. Infrastructure

6.3. Waterproofing Admixtures Market Size and Forecast, by Region (2023-2030)

6.3.1. North America

6.3.2. Europe

6.3.3. Asia Pacific

6.3.4. Middle East and Africa

6.3.5. South America

7. North America Waterproofing Admixtures Market Size and Forecast (by value Units)

7.1. North America Waterproofing Admixtures Market Size and Forecast, by Type (2023-2030)

7.1.1. Pore Blocking Admixtures

7.1.2. Crystalline Admixtures

7.1.3. Densifier

7.2. North America Waterproofing Admixtures Market Size and Forecast, by Application (2023-2030)

7.2.1. Residential

7.2.2. Commercial

7.2.3. Infrastructure

7.3. North America Waterproofing Admixtures Market Size and Forecast, by Country (2023-2030)

7.3.1. United States

7.3.2. Canada

7.3.3. Mexico

8. Europe Waterproofing Admixtures Market Size and Forecast (by Value Units)

8.1. Europe Waterproofing Admixtures Market Size and Forecast, by Type (2023-2030)

8.1.1. Pore Blocking Admixtures

8.1.2. Crystalline Admixtures

8.1.3. Densifier

8.2. Europe Waterproofing Admixtures Market Size and Forecast, by Application (2023-2030)

8.2.1. Residential

8.2.2. Commercial

8.2.3. Infrastructure

8.3. Europe Waterproofing Admixtures Market Size and Forecast, by Country (2023-2030)

8.3.1. UK

8.3.2. France

8.3.3. Germany

8.3.4. Italy

8.3.5. Spain

8.3.6. Sweden

8.3.7. Austria

8.3.8. Rest of Europe

9. Asia Pacific Waterproofing Admixtures Market Size and Forecast (by Value Units)

9.1. Asia Pacific Waterproofing Admixtures Market Size and Forecast, by Type (2023-2030)

9.1.1. Pore Blocking Admixtures

9.1.2. Crystalline Admixtures

9.1.3. Densifier

9.2. Asia Pacific Waterproofing Admixtures Market Size and Forecast, by Application (2023-2030)

9.2.1. Residential

9.2.2. Commercial

9.2.3. Infrastructure

9.3. Asia Pacific Waterproofing Admixtures Market Size and Forecast, by Country (2023-2030)

9.3.1. China

9.3.2. S Korea

9.3.3. Japan

9.3.4. India

9.3.5. Australia

9.3.6. Asean

9.3.7. Rest of Asia Pacific

10. Middle East and Africa Waterproofing Admixtures Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Waterproofing Admixtures Market Size and Forecast, by Type (2023-2030)

10.1.1. Pore Blocking Admixtures

10.1.2. Crystalline Admixtures

10.1.3. Densifier

10.2. Middle East and Africa Waterproofing Admixtures Market Size and Forecast, by Application (2023-2030)

10.2.1. Residential

10.2.2. Commercial

10.2.3. Infrastructure

10.3. Middle East and Africa Waterproofing Admixtures Market Size and Forecast, by Country (2023-2030)

10.3.1. South Africa

10.3.2. GCC

10.3.3. Rest of ME&A

11. South America Waterproofing Admixtures Market Size and Forecast (by Value Units)

11.1. South America Waterproofing Admixtures Market Size and Forecast, by Type (2023-2030)

11.1.1. Pore Blocking Admixtures

11.1.2. Crystalline Admixtures

11.1.3. Densifier

11.2. South America Waterproofing Admixtures Market Size and Forecast, by Application (2023-2030)

11.2.1. Residential

11.2.2. Commercial

11.2.3. Infrastructure

11.3. South America Waterproofing Admixtures Market Size and Forecast, by Country (2023-2030)

11.3.1. Brazil

11.3.2. Argentina

11.3.3. Rest of South America

12. Company Profile: Key players

12.1. Saint-Gobain S.A

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Mapei S.p.A.

12.3. Fosroc, Inc.

12.4. Penetron

12.5. Xypex Chemical Corporation

12.6. RPM International Inc.

12.7. CEMEX S.A.B. de C.V.

12.8. Sika AG

12.9. BASF

12.10. Pidilite Industries Limited

12.11. Wacker Chemie AG

12.12. Dr Fixit

12.13. Hard And Shine Chemicals

12.14. U.S. waterproofing

12.15. MUHU

12.16. Ardex Endura

12.17. Berger

12.18. Sunanda Global

12.19. XX.inc

13. Key Findings

14. Industry Recommendation