Whey Protein Market: Global Industry Analysis and Forecast (2024-2030)

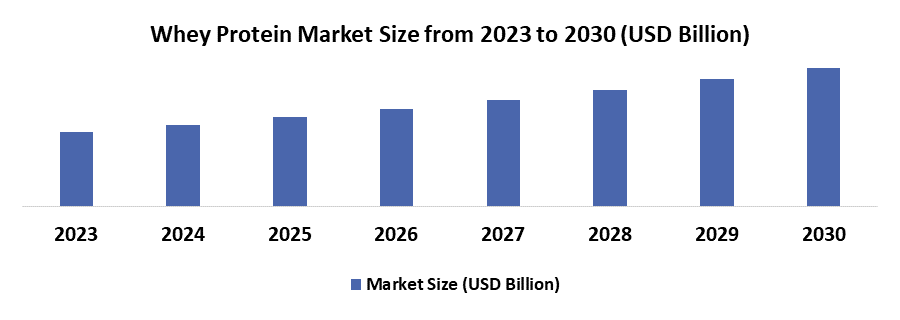

The Whey Protein Market size was valued at USD 8.86 Bn. in 2023 and the total Global Whey Protein revenue is expected to grow at a CAGR of 9.42% from 2024 to 2030, reaching nearly USD 16.64 Bn. by 2030.

Format : PDF | Report ID : SMR_2153

Whey Protein Market Overview

The global whey protein market is experiencing robust growth, driven by increasing health consciousness and the rising demand for high-protein diets. Whey protein, derived from milk during the cheese-making process, is a complete protein rich in essential amino acids, making it highly desirable across various applications. The market is segmented into sports nutrition, dietary supplements, infant formula, food additives, beverages, and animal feed, each contributing to the overall market expansion.

Sports nutrition leads the market, accounting for approximately 35% of the share, followed by dietary supplements and infant formula. The market's growth is bolstered by advancements in food processing technologies, expanding distribution channels, and a surge in fitness and wellness trends globally. Additionally, innovations in product formulations and the introduction of organic and natural variants are further propelling the market. As consumers become increasingly aware of the benefits of protein intake, the whey protein market is poised for continued expansion and diversification.

- The functional foods market, which heavily utilizes WPC, is expected to reach USD 275.77 billion by 2025, growing at a CAGR of 7.9%.

To get more Insights: Request Free Sample Report

Whey Protein Market Dynamics

Surging Demand and Innovation in Health and Wellness

The whey protein market is experiencing robust growth driven by rising health consciousness and the increasing popularity of fitness and wellness lifestyles. Consumers are turning to whey protein for its high-quality, complete protein profile, which supports muscle growth, weight management, and overall health. This surge is particularly evident among athletes, bodybuilders, and health enthusiasts seeking efficient ways to meet their protein needs. Innovations in product formulations, such as flavored powders, ready-to-drink shakes, and protein bars, are expanding market appeal. Additionally, the growing trend towards clean label products and natural ingredients is prompting manufacturers to focus on organic and grass-fed whey options. As awareness of the health benefits of whey protein spreads globally, the market is poised for continued expansion and diversification.

Quality Issues and Production Hurdles

The whey protein market faces significant challenges in production quality and efficiency, particularly in the manufacturing of dried whey powders. High levels of amorphous lactose led to caking, reducing powder yield during spray drying. This issue is compounded by the hygroscopic nature of whey, which decreases efficiency and quality. Studies highlight the need for reducing mineral and lactic acid content, and optimizing lactose pre-crystallization processes to mitigate these issues. For example, effective pre-crystallization decreases caking during storage, enhancing product quality. With the global whey protein market valued at around $8.86 billion in 2023 and projected to reach $16.64 billion by 2030, addressing these production challenges is crucial for sustaining growth and meeting market demand.

Whey Protein Market Segment Analysis

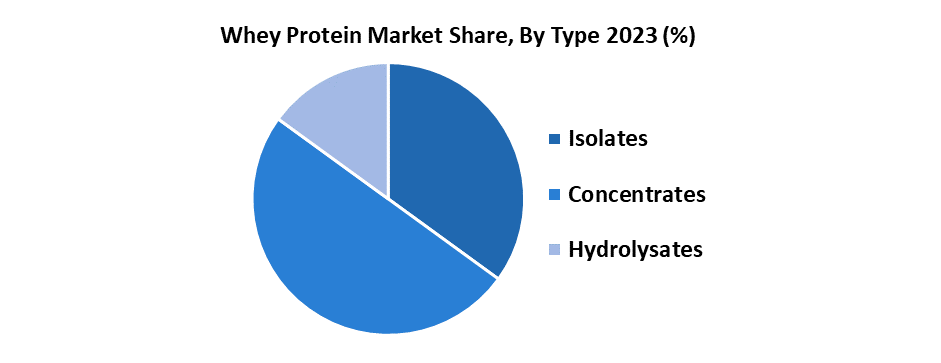

By Type, Whey Protein Concentrates (WPC) held the largest market share in the whey protein segment, accounting for approximately 50% of the market in 2023. This dominance is attributed to their cost-effectiveness and versatility, making them accessible to a broad consumer base, including fitness enthusiasts, health-conscious individuals, and the general population. WPC typically contains 70-80% protein, with the remaining composition including fats, lactose, and minerals, providing a balanced nutritional profile.

This type of whey protein is widely used in nutritional supplements, functional foods, beverages, and even infant formula due to its affordability and nutritional benefits. The market for WPC is driven by the increasing demand for protein-enriched foods and beverages, the rise of health and fitness trends, and the growing awareness of the benefits of protein in the diet. Additionally, its application in food fortification is expanding as consumers seek more nutritious and functional food options, further boosting its market presence.

- WPC is less expensive compared to Whey Protein Isolates (WPI) and Whey Protein Hydrolysates (WPH), making it more accessible to a wider range of consumers.

- WPC is extensively used in nutritional supplements, sports nutrition products, functional foods, beverages, and infant formula.

- According to a stellar analysis, 60% of consumers reported increasing their protein intake as part of their dietary habits, with WPC being a popular choice thanks to its balanced nutritional profile and affordability.

Whey Protein Market Regional Analysis

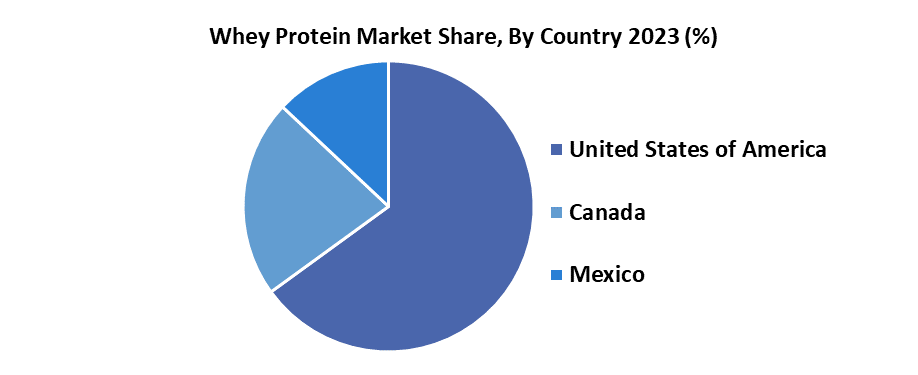

North America has dominated the Whey Protein Market, which held the largest market share accounting for 35% in 2023, the region is expected to grow during the forecast period and maintain its dominance by 2030. North America holds the largest share of the global whey protein market, driven by the high consumption of dietary supplements, functional foods, and sports nutrition products. The United States, in particular, is a major consumer thanks to a strong fitness culture and significant demand for protein-rich diets. The region benefits from advanced food processing technology and a high level of health and fitness awareness among consumers. Additionally, the presence of major whey protein manufacturers and a robust distribution network further bolster the market.

Europe is a significant market for whey protein, characterized by a high demand for nutritional supplements and functional foods. Countries like Germany, the UK, and France lead in consumption. The whey protein market is driven by the rising trend of healthy lifestyles and dietary supplements, along with stringent regulatory standards ensuring high product quality. Additionally, the growing elderly population in Europe increases the demand for protein supplements aimed at maintaining muscle mass and overall health.

The Asia-Pacific region is the fastest-growing market for whey protein, fueled by increasing health consciousness and a growing middle class with disposable income. Countries such as China, India, Japan, and Australia are key whey protein markets. The rising adoption of Western dietary habits, increased participation in fitness activities, and the booming food and beverage industry contribute to this growth. Additionally, the expanding e-commerce sector makes whey protein products more accessible to consumers in this region.

Whey Protein Market Competitive Landscape

The whey protein market's competitive landscape is characterized by intense rivalry among key players, each striving for innovation and market share. Major companies lead the industry with advanced whey protein products catering to the growing demand for high-protein foods. These firms are investing heavily in research and development to create differentiated offerings, such as specialized whey protein concentrates and isolates, to meet diverse consumer needs. Additionally, strategic partnerships, mergers, and acquisitions are common as companies seek to expand their global reach and enhance their product portfolios. This competitive environment drives continuous advancements and ensures a wide variety of high-quality whey protein products are available to consumers for instance,

5 Jan 2024, Lactalis has unveiled a solar thermal power plant dedicated to sustainable whey production, marking a significant step towards eco-friendly manufacturing practices.

9 November 2023, Fonterra's breakthrough whey protein concentrate, Pro-Optima™ Grade A fWPC, revolutionizes cultured products, catering to the growing demand for high-protein foods. Research shows 65% of consumers seek more protein for its health benefits. This innovation by Fonterra's Research and Development Centre ensures high-quality, protein-rich yoghurts made with US milk, meeting the needs of health-conscious consumers.

7 November 2023, Arla Foods Ingredients is addressing the rising demand for high-protein products in Africa and the Middle East, where high-protein claims have grown by 17.64% annually. At Gulfood Manufacturing in Dubai, they have showcased innovative whey protein concepts, including high-protein ice cream, fermented protein drinks, and clear protein-enriched juice, emphasizing quality and taste.

|

Whey Protein Market Scope |

|

|

Market Size in 2023 |

USD 8.86 Bn |

|

Market Size in 2030 |

USD 16.64 Bn |

|

CAGR (2024-2030) |

9.42% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

by Application Sports Nutrition Dietary Supplements Infant Formula Food Additives Beverages Feed |

|

by Type Isolates Concentrates Hydrolysates |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Whey Protein Market

- Hilmar Cheese Company, Inc.

- Saputo Inc.

- Glanbia plc

- Fonterra Co-operative Group Ltd.

- Arla Foods

- Alpavit

- Wheyco GmbH

- Milk Specialties

- Carbery Group

- LACTALIS Ingredients

- Olam International

- Davisco Foods International, Inc.

- Leprino Foods Company

- Nestle S.A.

- Nutricia (Danone)

- Abbott

- Sanofi S.A.

- Now Health Group, Inc.

- Nutiva Inc

- The Simply Good Food Co

- Iovate Health Sciences International Inc.

- MusclePharm Corporation

- Kerry Group Plc

- CytoSport, Inc.

- Reliance Vitamin Company, Inc.

- Herbalife Nutrition, Inc.

- General Nutrition Centers (GNC) Holdings, Inc.

- Orgain Inc.

- True Nutrition

- XX Inc

Frequently Asked Questions

The growth of the whey protein market is driven by several key factors, increasing health and fitness awareness among consumers, amino acid profile and high bioavailability, and weight management.

Investors capitalize on opportunities in the whey protein market by focusing on several strategic areas. Launching of a new product formulation, marketing on e-commerce and direct-to-consumer sales benefits different opportunities in the whey protein market.

The Market size was valued at USD 8.86 billion in 2023 and the total Market revenue is expected to grow at a CAGR of 9.42% from 2024 to 2030, reaching nearly USD 16.64 billion.

1. Whey Protein Market: Research Methodology

2. Whey Protein Market: Executive Summary

3. Whey Protein Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Whey Protein Market: Dynamics

5.1. Market Driver

5.1.1. Increasing Consumer Awareness

5.1.2. Innovation in Product Offerings

5.2. Market Trends

5.3. Market Restraints

5.4. Market Opportunities

5.5. Market Challenges

5.6. PORTER’s Five Forces Analysis

5.7. PESTLE Analysis

5.8. Strategies for New Entrants to Penetrate the Market

5.9. Regulatory Landscape by Region

5.9.1. North America

5.9.2. Europe

5.9.3. Asia Pacific

5.9.4. Middle East and Africa

5.9.5. South America

6. Whey Protein Market Size and Forecast by Segments (by Value Units)

6.1. Whey Protein Market Size and Forecast, by Application (2023-2030)

6.1.1. Sports Nutrition

6.1.2. Dietary Supplements

6.1.3. Infant Formula

6.1.4. Food Additives

6.1.5. Beverages

6.1.6. Feed

6.2. Whey Protein Market Size and Forecast, by Type (2023-2030)

6.2.1. Isolates

6.2.2. Concentrates

6.2.3. Hydrolysates

6.3. Whey Protein Market Size and Forecast, by Region (2023-2030)

6.3.1. North America

6.3.2. Europe

6.3.3. Asia Pacific

6.3.4. Middle East and Africa

6.3.5. South America

7. North America Whey Protein Market Size and Forecast (by Value Units)

7.1. North America Whey Protein Market Size and Forecast, by Application (2023-2030)

7.1.1. Sports Nutrition

7.1.2. Dietary Supplements

7.1.3. Infant Formula

7.1.4. Food Additives

7.1.5. Beverages

7.1.6. Feed

7.2. North America Whey Protein Market Size and Forecast, by Type (2023-2030)

7.2.1. Isolates

7.2.2. Concentrates

7.2.3. Hydrolysates

7.3. North America Whey Protein Market Size and Forecast, by Country (2023-2030)

7.3.1. United States

7.3.2. Canada

7.3.3. Mexico

8. Europe Whey Protein Market Size and Forecast (by Value Units)

8.1. Europe Whey Protein Market Size and Forecast, by Application (2023-2030)

8.1.1. Sports Nutrition

8.1.2. Dietary Supplements

8.1.3. Infant Formula

8.1.4. Food Additives

8.1.5. Beverages

8.1.6. Feed

8.2. Europe Whey Protein Market Size and Forecast, by Type (2023-2030)

8.2.1. Isolates

8.2.2. Concentrates

8.2.3. Hydrolysates

8.3. Europe Whey Protein Market Size and Forecast, by Country (2023-2030)

8.3.1. UK

8.3.2. France

8.3.3. Germany

8.3.4. Italy

8.3.5. Spain

8.3.6. Sweden

8.3.7. Austria

8.3.8. Rest of Europe

9. Asia Pacific Whey Protein Market Size and Forecast (by Value Units)

9.1. Asia Pacific Whey Protein Market Size and Forecast, by Application (2023-2030)

9.1.1. Sports Nutrition

9.1.2. Dietary Supplements

9.1.3. Infant Formula

9.1.4. Food Additives

9.1.5. Beverages

9.1.6. Feed

9.2. Asia Pacific Whey Protein Market Size and Forecast, by Type (2023-2030)

9.2.1. Isolates

9.2.2. Concentrates

9.2.3. Hydrolysates

9.3. Asia Pacific Whey Protein Market Size and Forecast, by Country (2023-2030)

9.3.1. China

9.3.2. S Korea

9.3.3. Japan

9.3.4. India

9.3.5. Australia

9.3.6. Indonesia

9.3.7. Malaysia

9.3.8. Vietnam

9.3.9. Taiwan

9.3.10. Bangladesh

9.3.11. Pakistan

9.3.12. Rest of Asia Pacific

10. Middle East and Africa Whey Protein Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Whey Protein Market Size and Forecast, by Application (2023-2030)

10.1.1. Sports Nutrition

10.1.2. Dietary Supplements

10.1.3. Infant Formula

10.1.4. Food Additives

10.1.5. Beverages

10.1.6. Feed

10.2. Middle East and Africa Whey Protein Market Size and Forecast, by Type (2023-2030)

10.2.1. Isolates

10.2.2. Concentrates

10.2.3. Hydrolysates

10.3. Middle East and Africa Single-Use Filtration Assembly Market Size and Forecast, by Country (2023-2030)

10.3.1. South Africa

10.3.2. GCC

10.3.3. Egypt

10.3.4. Nigeria

10.3.5. Rest of ME&A

11. South America Whey Protein Market Size and Forecast (by Value Units)

11.1. South America Whey Protein Market Size and Forecast, by Application (2023-2030)

11.1.1. Sports Nutrition

11.1.2. Dietary Supplements

11.1.3. Infant Formula

11.1.4. Food Additives

11.1.5. Beverages

11.1.6. Feed

11.2. South America Whey Protein Market Size and Forecast, by Type (2023-2030)

11.2.1. Isolates

11.2.2. Concentrates

11.2.3. Hydrolysates

11.3. South America Whey Protein Market Size and Forecast, by Country (2023-2030)

11.3.1. Brazil

11.3.2. Argentina

11.3.3. Rest of South America

12. Company Profile: Key players

12.1. Hilmar Cheese Company, Inc.

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Saputo Inc.

12.3. Glanbia plc

12.4. Fonterra Co-operative Group Ltd.

12.5. Arla Foods

12.6. Alpavit

12.7. Wheyco GmbH

12.8. Milk Specialties

12.9. Carbery Group

12.10. LACTALIS Ingredients

12.11. Olam International

12.12. Davisco Foods International, Inc.

12.13. Leprino Foods Company

12.14. Nestle S.A.

12.15. Nutricia (Danone)

12.16. Abbott

12.17. Sanofi S.A.

12.18. Now Health Group, Inc.

12.19. Nutiva Inc

12.20. The Simply Good Food Co

12.21. Iovate Health Sciences International Inc.

12.22. MusclePharm Corporation

12.23. Kerry Group Plc

12.24. CytoSport, Inc.

12.25. Reliance Vitamin Company, Inc.

12.26. Herbalife Nutrition, Inc.

12.27. General Nutrition Centers (GNC) Holdings, Inc.

12.28. Orgain Inc.

12.29. True Nutrition

12.30. XX Inc

13. Key Findings

14. Industry Recommendations