Wind Energy Market: Global Industry Analysis and Forecast (2024-2030)

The Wind Energy Market size was valued at USD 71 Bn. in 2023 and the total Wind Energy revenue is expected to grow at a CAGR of 9.5% from 2024 to 2030, reaching nearly USD 85.13 Bn. by 2030.

Format : PDF | Report ID : SMR_2141

Wind Energy Market Overview:

Wind energy is a rapidly advancing technology with significant potential to harness clean energy from both land-based and offshore wind sources. It is recognized as the most efficient and environmentally sustainable method for energy production, characterized by zero emissions, local generation, and inexhaustibility. This renewable energy source not only helps reduce reliance on fossil fuels, which are the primary contributors to greenhouse gases and global warming but also promotes economic growth and competitiveness. Currently, wind energy accounts for 5 percent of global electricity production and 8 percent of the U.S. electricity supply, indicating its growing significance in the energy sector.

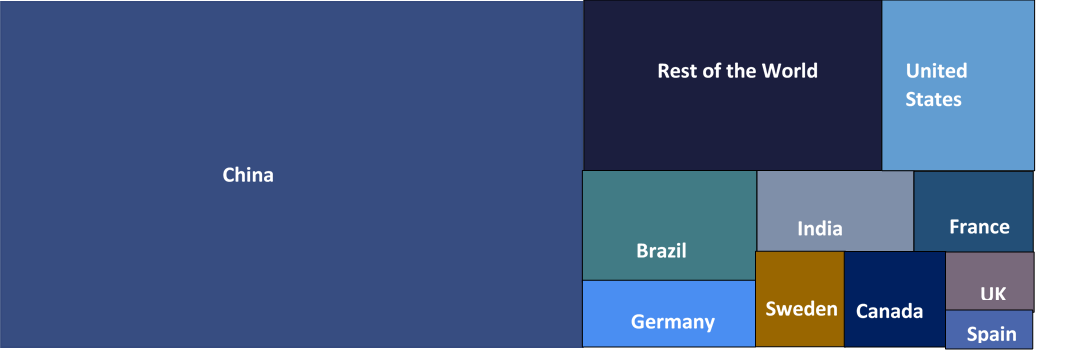

In 2023 China leads the global wind energy market in onshore wind turbine nacelle assembly, boasting an annual capacity of 82 GW. Europe follows with 21.6 GW, then the US with 13.6 GW, India with 11.5 GW, and Latin America with 6.2 GW. The supply chain for offshore wind turbines, however, is more concentrated, with over 99% of installations located in Europe and the Asia-Pacific region. This highlights the regional disparities and specialized focus within the wind energy market, underscoring the strategic importance of wind energy in global efforts to transition to sustainable energy solutions. China is the world's leading center for offshore turbine nacelle production, with an annual assembly capacity of up to 16 GW, including 1 GW owned by a Western turbine OEM.

The U.S. Department of Energy (DOE) has reported that wind energy remains one of the fastest-growing and most cost-effective sources of electricity in America, with strong prospects for rapid expansion. In 2022, wind power accounted for 22% of the new electricity capacity installed in the United States, second only to solar. This growth represented a $12 billion capital investment and supported over 125,000 jobs. Fourteen states installed new utility-scale land-based wind turbines in 2022, with Texas leading by adding 4,028 MW of capacity. Oklahoma and Nebraska were also significant contributors, each adding over 600 MW of new capacity.

To get more Insights: Request Free Sample Report

Wind Energy Market Dynamics:

Delivering the Big Ambitions of Global Offshore Wind which Propel the Wind Energy Market

Wind energy is a driving force for U.S. economic growth, environmental sustainability, and community development. In 2022, wind turbines operating in all 50 states contributed over 10% of the nation's net energy production, highlighting their significant role in the energy mix. This widespread adoption of wind power not only supports energy independence but also generates substantial economic benefits. Investments in new wind projects in 2022 alone added $20 billion to the U.S. economy, underscoring the sector's potential for continued financial growth. One of the key factors driving the wind energy market is its status as a clean and renewable energy source.

Wind turbines convert wind energy into electricity through mechanical power, eliminating the need to burn fuel and reducing air pollution. This renewable resource is abundant and inexhaustible, ensuring a stable supply of energy that can significantly diminish reliance on fossil fuels. In the U.S., wind energy helps avoid 336 million metric tons of carbon dioxide emissions annually, equivalent to the emissions from 73 million cars, demonstrating its crucial role in mitigating climate change and promoting environmental health. The wind power provides substantial benefits to local communities.

Wind energy projects generate approximately $2 billion annually in state and local tax payments and land-lease payments, providing essential revenue for communities. This additional income is directed towards improving school budgets, reducing the tax burden on homeowners, and addressing local infrastructure needs. By fostering local economic development, wind energy not only supports national growth but also enhances the quality of life for individuals in wind-rich areas.

Wind energy is driven by its cost-effectiveness and adaptability to various environments. Land-based, utility-scale wind turbines are among the most affordable energy sources available today. This cost advantage is further enhanced by ongoing advancements in wind energy science and technology, which continue to improve its competitiveness and efficiency. Additionally, wind turbines' versatility in different settings is a significant driving factor for the wind energy market.

Wind energy generation is highly compatible with agricultural and multi-use working landscapes, making it an ideal solution for rural and remote areas. Farms, ranches, and coastal, and island communities often have high-quality wind resources, allowing wind energy to be seamlessly integrated into these regions. This adaptability not only supports local energy needs but also complements existing land uses without significant disruption.

Impact of Wind Energy on Wildlife Mitigation Strategies hampered the growth of the Wind Energy Market

The wind energy market is characterized by its growing competitiveness and unique challenges. As one of the most cost-effective sources of electricity, land-based utility-scale wind turbines offer significant economic advantages. When comparing the cost of energy associated with new power plants, wind and solar projects are now more economically viable than gas, geothermal, coal, or nuclear facilities. However, the cost-effectiveness of wind projects can vary depending on location; areas with insufficient wind may not benefit as much. Advances in next-generation technology, manufacturing improvements, and a deeper understanding of wind plant physics are essential for further reducing costs and enhancing competitiveness.

Ideal wind sites are often located in remote areas, presenting installation and transmission challenges. To meet urban demand, it is crucial to upgrade the nation’s transmission network, connecting regions with abundant wind resources to population centers. Enhancements in offshore wind energy transmission and grid interconnection capabilities are also making significant progress, facilitating the expansion of wind energy infrastructure.

Despite the environmental benefits of wind energy, there are concerns regarding the noise produced by turbine blades and their visual impact on the landscape. While these impacts differ from those of conventional power plants, they remain a consideration for communities near wind farms. Addressing these concerns through thoughtful design and community engagement is vital for the acceptance and success of wind projects. Additionally, wind plants can affect local wildlife, though they generally have lower impacts compared to other energy developments. Ongoing research and technological advancements aim to minimize wind-wildlife interactions. Properly siting wind plants and continuing environmental research is crucial for reducing the impact of turbines on wildlife, ensuring that wind energy remains a sustainable option that restrains the Wind Energy Market.

Wind Energy's Role in Global Renewable Transition Boosts the Wind Energy Market

In North America, 60 GW of new onshore wind capacity is projected to be added over the next five years, with the United States accounting for 92% of this expansion and the remainder in Canada. Europe is poised for a resurgence in its onshore wind energy market starting in 2024, with established markets like Germany, Spain, the UK, France, Italy, and Turkey leading the growth. In the Africa/Middle East region, 17 GW of new wind capacity is expected between 2023 and 2027, with significant contributions from South Africa, Egypt, Saudi Arabia, and Morocco. Latin America is anticipated to add 26.5 GW of onshore wind capacity in the next five years, with Brazil, Chile, and Colombia contributing 78% of this increase.

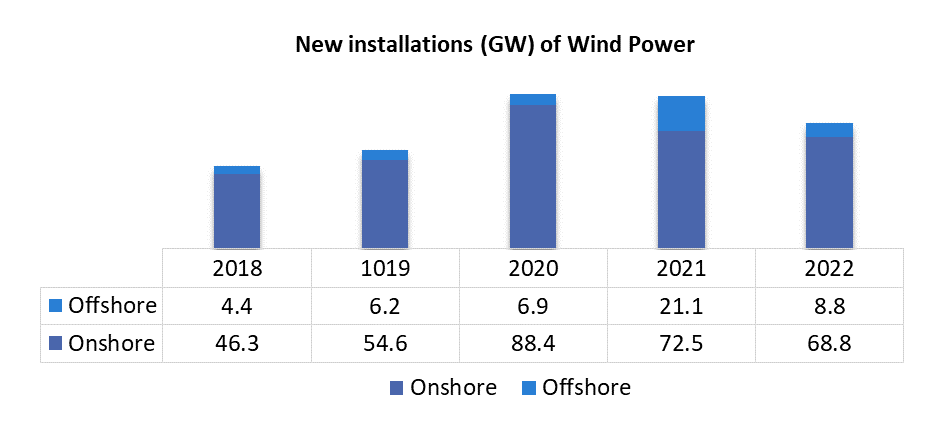

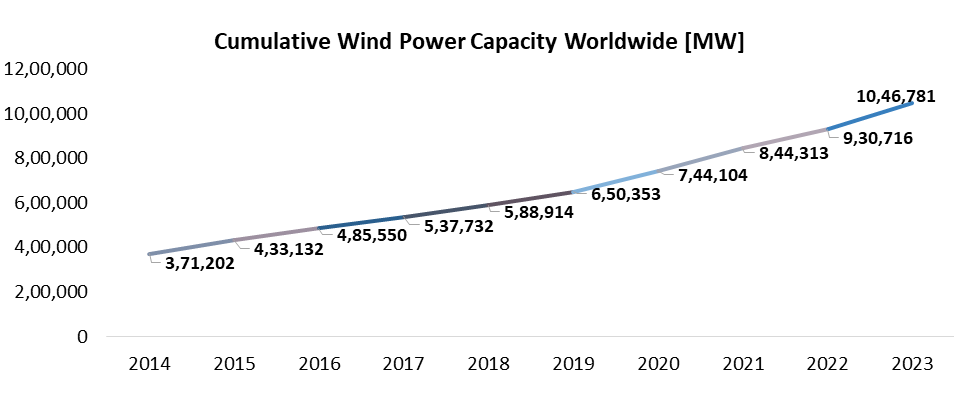

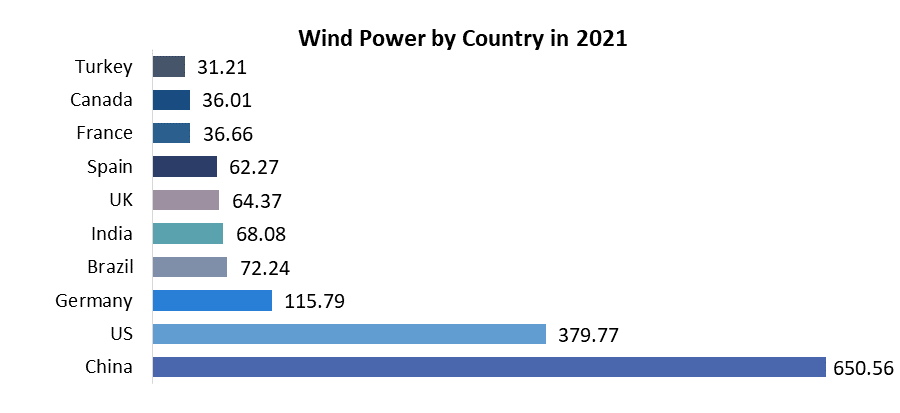

The year 2023 marked a milestone for the global wind energy market, with the installation of 117 GW of new wind power capacity, a 50% increase from the previous year, making it the best year for new wind projects on record. This growth is reflected in the substantial increase in world wind electricity generation, which rose from 3.6 billion kWh in 1990 to 2,904 billion kWh in 2022, with 127 countries now generating wind electricity. The leading countries in wind electricity generation in 2022 were China, the United States, Germany, Brazil, and the United Kingdom, collectively contributing significant shares to the global total.

In the United States, wind energy accounted for about 10% of total utility-scale electricity generation in 2023, with Texas, Iowa, Oklahoma, Kansas, and Illinois producing 59% of the nation's wind electricity. These regional and global developments underscore the driving factors behind the wind energy market's rapid expansion: strong policy support, technological advancements, and increasing cost competitiveness. As more countries and regions invest in wind energy infrastructure, the sector is set to play a crucial role in the transition to sustainable and renewable energy sources worldwide. The global wind energy market is experiencing significant growth driven by various regional developments and record-setting installations.

Wind Energy Market Segment Analysis:

Based on Type: the market is divided into Onshore and Offshore types. Among these onshore wind energy witnessed the highest market share in 2023 and continued its dominance in the forecast period. Onshore wind energy is a vital component of the renewable energy landscape, harnessing the natural movement of wind to generate electricity using turbines located on land. Originating from early uses in the 1880s for tasks like pumping water and milling grain, the modern era of onshore wind began with the commercial development exemplified by the Delabole wind farm in 1991 in the UK.

Today, Great Britain hosts over 1,500 operational onshore wind farms, collectively generating more than 12 gigawatt hours (GWh) of electricity annually, contributing significantly to the national grid. In 2020 alone, onshore wind supplied 11% of the UK's electricity needs, with a robust output of 34.7 terawatt hours (TWh), sufficient to power 18.5 million homes for a year.

The advantages of onshore wind power are multifaceted. It boasts a reduced environmental impact compared to traditional fossil fuel-based energy sources, with lower emissions during both construction and operation. These wind farms can often be sited on land that remains available for other uses, such as agriculture, thereby supporting rural economies and maintaining land productivity. Economically, onshore wind is among the most cost-effective forms of renewable energy, alongside solar photovoltaics (PV), offering cheaper infrastructure and operational costs than offshore wind projects.

The quicker installation times and simpler maintenance requirements further enhance its appeal, making large-scale deployment feasible in relatively short timeframes and ensuring ongoing operational efficiency not only bolsters local economies but also fosters a skilled workforce capable of supporting the renewable energy sector's growth. With ongoing technological advancements and supportive policy frameworks, onshore wind energy continues to play a crucial role in diversifying energy sources, reducing carbon emissions, and enhancing energy security, positioning it as a cornerstone of sustainable energy solutions globally.

Wind Energy Market Regional Analysis:

Asia witnessed the highest Wind Energy Market share in 2023 and continued its dominance during the forecast period. Asia as a region is witnessing dynamic growth in wind energy deployment, led primarily by China's substantial contributions. The region's growth trajectory is bolstered by India's persistent expansion efforts, Japan's strategic investments, and Vietnam's rapid emergence. These countries are leveraging wind power to meet increasing electricity demands sustainably and to mitigate climate change impacts, reflecting a broader trend towards renewable energy adoption across Asia.

China's wind energy industry continues to dominate the global wind power development landscape. In 2023, the country added a staggering 75 gigawatts (GW) of new wind capacity, setting a new global record. This amount represents 65% of the global market for new wind turbines, up from 58% in 2022. With an annual growth rate of 19.2%, China is on track to surpass the half-terawatt mark in 2024, solidifying its role as a leader in global wind power development.

India added 3.1 GW of new wind capacity in 2023, maintaining its position as the fifth largest market globally, just behind Germany. Despite facing challenges, India remains committed to ambitious targets and is expected to continue ranking fourth in terms of overall wind capacity in the coming years. Future growth is anticipated from repowering initiatives and the upcoming development of offshore wind projects.

Japan added 5.2 GW of new wind capacity in 2023, making it the third-largest market in Asia. The country's steady growth in wind power reflects ongoing efforts to diversify its energy mix and reduce reliance on nuclear power following the Fukushima disaster. Japan's investment in wind energy Wind Energy Market continues to support its energy transition goals.

Vietnam emerged as a significant player in the Asian wind energy market, adding 4.9 GW of new capacity in 2023. This growth represents the highest growth rate in the region at 23.6%. Vietnam's rapid expansion in wind power is driven by favorable government policies, increasing energy demand, and efforts to diversify its energy sources away from coal.

|

Wind Energy Market Scope |

|

|

Market Size in 2023 |

USD 71 Billion |

|

Market Size in 2030 |

USD 85.13 Billion |

|

CAGR (2024-2030) |

9.5% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Type Onshore Offshore |

|

By End-user Industrial Commercial Residential |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Wind Energy Market

- Vestas Wind Systems (Aarhus, Denmark)

- Siemens Gamesa Renewable Energy (Zamudio, Spain)

- GE Renewable Energy (Paris, France)

- Nordex SE (Hamburg, Germany)

- Enercon (Aurich, Germany)

- Goldwind (Beijing, China)

- Suzlon Energy Limited (Pune, India)

- MingYang Smart Energy (Zhongshan, China)

- Envision Energy (Shanghai, China)

- Senvion (Hamburg, Germany)

- Sinovel Wind Group (Beijing, China)

- Dongfang Electric Corporation (Chengdu, China)

- Acciona Windpower (Madrid, Spain)

- Nordex Acciona (Hamburg, Germany)

- Windey Co., Ltd. (Hangzhou, China)

- United Power (Beijing, China)

- NextEra Energy Resources (Juno Beach, Florida, USA)

- Ørsted (Fredericia, Denmark)

- Siemens AG (Munich, Germany)

- E.ON Climate & Renewables (Essen, Germany)

Frequently Asked Questions

The growth of the wind energy market is driven by declining costs of wind technology, government incentives and policies promoting renewable energy, and increasing demand for sustainable energy solutions to combat climate change. Technological advancements and innovations in wind turbine design also play a crucial role.

Key opportunities in the wind energy market include the expansion of offshore wind farms, the integration of wind power with energy storage solutions, and the development of hybrid renewable energy systems.

Wind Energy Market size was valued at USD 71 Billion in 2023 and the total Global Wind Energy revenue is expected to grow at a CAGR of 9.5% from 2024 to 2030, reaching nearly USD 85.13 Billion by 2030.

The segments covered in the market report are Type, End-User, and region.

1. Wind Energy Market: Research Methodology

2. Wind Energy Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Global Wind Energy Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Service Segment

3.3.3. End-user Segment

3.3.4. Revenue (2022)

3.3.5. Company Locations

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Mergers and Acquisitions Details

4. Wind Energy Market: Dynamics

4.1. Wind Energy Market Trends

4.2. Wind Energy Market Dynamics

4.2.1.1. Drivers

4.2.1.2. Restraints

4.2.1.3. Opportunities

4.2.1.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technology Roadmap

4.6. Regulatory Landscape by Region

4.6.1. North America

4.6.2. Europe

4.6.3. Asia Pacific

4.6.4. Middle East and Africa

4.6.5. South America

5. Wind Energy Market: Global Market Size and Forecast (Value in USD Million) (2023-2030)

5.1. Wind Energy Market Size and Forecast, By Type (2023-2030)

5.1.1. Onshore

5.1.2. Offshore

5.2. Wind Energy Market Size and Forecast, By End-user (2023-2030)

5.2.1. Industrial

5.2.2. Commercial

5.2.3. Residential

5.3. Wind Energy Market Size and Forecast, by Region (2023-2030)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Wind Energy Market Size and Forecast by Segmentation (Value in USD Million) (2023-2030)

6.1. North America Wind Energy Market Size and Forecast, By Type (2023-2030)

6.1.1. Onshore

6.1.2. Offshore

6.2. North America Wind Energy Market Size and Forecast, By End-user (2023-2030)

6.2.1. Industrial

6.2.2. Commercial

6.2.3. Residential

6.3. North America Wind Energy Market Size and Forecast, by Country (2023-2030)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Wind Energy Market Size and Forecast by Segmentation (Value in USD Million) (2023-2030)

7.1. Europe Wind Energy Market Size and Forecast, By Type (2023-2030)

7.2. Europe Wind Energy Market Size and Forecast, By End-user (2023-2030)

7.3. Europe Wind Energy Market Size and Forecast, by Country (2023-2030)

7.3.1. United Kingdom

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Russia

7.3.8. Rest of Europe

8. Asia Pacific Wind Energy Market Size and Forecast by Segmentation (Value in USD Million) (2023-2030)

8.1. Asia Pacific Wind Energy Market Size and Forecast, By Type (2023-2030)

8.2. Asia Pacific Wind Energy Market Size and Forecast, By End-user (2023-2030)

8.3. Asia Pacific Wind Energy Market Size and Forecast, by Country (2023-2030)

8.3.1. China

8.3.1.1. China Wind Energy Market Size and Forecast, By Type (2023-2030)

8.3.1.2. China Wind Energy Market Size and Forecast, By End-user (2023-2030)

8.3.2. S Korea

8.3.2.1. S Korea Wind Energy Market Size and Forecast, By Type (2023-2030)

8.3.2.2. S Korea Wind Energy Market Size and Forecast, By End-user (2023-2030)

8.3.3. Japan

8.3.3.1. Japan Wind Energy Market Size and Forecast, By Type (2023-2030)

8.3.3.2. Japan Wind Energy Market Size and Forecast, By End-user (2023-2030)

8.3.4. India

8.3.4.1. India Wind Energy Market Size and Forecast, By Type (2023-2030)

8.3.4.2. India Wind Energy Market Size and Forecast, By End-user (2023-2030)

8.3.5. Australia

8.3.5.1. Australia Wind Energy Market Size and Forecast, By Type (2023-2030)

8.3.5.2. Australia Wind Energy Market Size and Forecast, By End-user (2023-2030)

8.3.6. ASEAN

8.3.6.1. ASEAN Wind Energy Market Size and Forecast, By Type (2023-2030)

8.3.6.2. ASEAN Wind Energy Market Size and Forecast, By End-user (2023-2030)

8.3.7. Rest of Asia Pacific

8.3.7.1. Rest of Asia Pacific Wind Energy Market Size and Forecast, By Type (2023-2030)

8.3.7.2. Rest of Asia Pacific Wind Energy Market Size and Forecast, By End-user (2023-2030)

9. Middle East and Africa Wind Energy Market Size and Forecast by Segmentation (Value in USD Million) (2023-2030)

9.1. Middle East and Africa Wind Energy Market Size and Forecast, By Type (2023-2030)

9.2. Middle East and Africa Wind Energy Market Size and Forecast, By End-user (2023-2030)

9.3. Middle East and Africa Wind Energy Market Size and Forecast, by Country (2023-2030)

9.3.1. South Africa

9.3.1.1. South Africa Wind Energy Market Size and Forecast, By Type (2023-2030)

9.3.1.2. South Africa Wind Energy Market Size and Forecast, By End-user (2023-2030)

9.3.2. GCC

9.3.2.1. GCC Wind Energy Market Size and Forecast, By Type (2023-2030)

9.3.2.2. GCC Wind Energy Market Size and Forecast, By End-user (2023-2030)

9.3.3. Nigeria

9.3.3.1. Nigeria Wind Energy Market Size and Forecast, By Type (2023-2030)

9.3.3.2. Nigeria Wind Energy Market Size and Forecast, By End-user (2023-2030)

9.3.4. Rest of ME&A

9.3.4.1. Rest of ME&A Wind Energy Market Size and Forecast, By Type (2023-2030)

9.3.4.2. Rest of ME&A Wind Energy Market Size and Forecast, By End-user (2023-2030)

10. South America Wind Energy Market Size and Forecast by Segmentation (Value in USD Million) (2023-2030)

10.1. South America Wind Energy Market Size and Forecast, By Type (2023-2030)

10.2. South America Wind Energy Market Size and Forecast, By End-user (2023-2030)

10.3. South America Wind Energy Market Size and Forecast, by Country (2023-2030)

10.3.1. Brazil

10.3.1.1. Brazil Wind Energy Market Size and Forecast, By Type (2023-2030)

10.3.1.2. Brazil Wind Energy Market Size and Forecast, By End-user (2023-2030)

10.3.2. Argentina

10.3.2.1. Argentina Wind Energy Market Size and Forecast, By Type (2023-2030)

10.3.2.2. Argentina Wind Energy Market Size and Forecast, By End-user (2023-2030)

10.3.3. Rest Of South America

10.3.3.1. Rest Of South America Wind Energy Market Size and Forecast, By Type (2023-2030)

10.3.3.2. Rest Of South America Wind Energy Market Size and Forecast, By End-user (2023-2030)

11. Company Profile: Key Players

11.1. Vestas Wind Systems (Aarhus, Denmark)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Siemens Gamesa Renewable Energy (Zamudio, Spain)

11.3. GE Renewable Energy (Paris, France)

11.4. Nordex SE (Hamburg, Germany)

11.5. Enercon (Aurich, Germany)

11.6. Goldwind (Beijing, China)

11.7. Suzlon Energy Limited (Pune, India)

11.8. MingYang Smart Energy (Zhongshan, China)

11.9. Envision Energy (Shanghai, China)

11.10. Senvion (Hamburg, Germany)

11.11. Sinovel Wind Group (Beijing, China)

11.12. Dongfang Electric Corporation (Chengdu, China)

11.13. Acciona Windpower (Madrid, Spain)

11.14. Nordex Acciona (Hamburg, Germany)

11.15. Windey Co., Ltd. (Hangzhou, China)

11.16. United Power (Beijing, China)

11.17. NextEra Energy Resources (Juno Beach, Florida, USA)

11.18. Ørsted (Fredericia, Denmark)

11.19. Siemens AG (Munich, Germany)

11.20. E.ON Climate & Renewables (Essen, Germany)

12. Key Findings

13. Industry Recommendations